A credit score is a crucial financial metric that affects various aspects of your financial life. If you have a 678 credit score, you’re in a unique position – neither excellent nor poor, but with room for improvement and opportunities to leverage. This article will dive deep into what a 678 credit score means, its implications, and how you can make the most of it.

Skale Money Key Takeaways

- A 678 credit score is considered “good” by most lenders

- This score puts you above the national average

- You have decent approval odds for many financial products

- There’s potential to improve your score and access better terms

Table of Contents

Understanding Credit Scores

Credit scores are numerical representations of your creditworthiness. They help lenders assess the risk of lending to you.

- Credit scores typically range from 300 to 850

- Factors include payment history, credit utilization, and credit mix

- FICO and VantageScore are the most common scoring models

Tips: Familiarize yourself with your credit report and the factors that influence your score. This knowledge is crucial for maintaining and improving your 678 credit score and aiming for higher scores such as the 759 credit score.

Where Does a 678 Credit Score Stand?

A 678 credit score falls within the “good” range, indicating a responsible credit user.

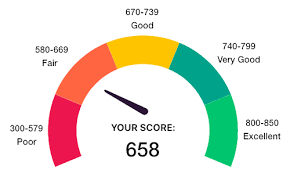

- Credit score categories: Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), Excellent (800-850)

- 678 is above the national average of 711 (as of 2021)

- Lenders generally view a 678 score favorably

Tips: While a 678 credit score is good, aiming for the “very good” range can unlock even better financial opportunities.

Advantages of a 678 Credit Score

With a 678 credit score, you’ll enjoy several benefits in the financial marketplace.

- High likelihood of loan approval for most products

- Interest rates lower than those offered to fair or poor credit holders

- Access to a variety of credit card options with decent rewards

Tips: Leverage your good credit score to negotiate better terms on loans and credit cards. Don’t settle for the first offer you receive.

Challenges with a 678 Credit Score

Despite its advantages, a 678 credit score may still present some limitations.

- You might not qualify for the best interest rates available

- Some premium credit cards may be out of reach

- You may have less bargaining power compared to those with excellent credit

Tips: Address these challenges by continuing to improve your credit score and shopping around for the best offers available to you.

Factors Influencing Your 678 Credit Score

Understanding what impacts your 678 credit score is crucial for maintaining and improving it.

- Payment history (35% of FICO score)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit inquiries (10%)

Tips: Focus on making timely payments and keeping your credit utilization low, as these factors have the most significant impact on your score.

Strategies to Improve a 678 Credit Score

To boost your 678 credit score, consider these effective strategies:

- Pay all bills on time, every time

- Reduce credit card balances to lower utilization

- Avoid applying for new credit unless necessary

- Maintain a mix of credit types (e.g., credit cards, installment loans)

Tips: Set up automatic payments to ensure timeliness, and aim to keep your credit utilization below 30% for optimal results. Aim for a higher credit score like a 685 credit score.

Maintaining a 678 Credit Score

Once you’ve achieved a 678 credit score, it’s important to maintain it.

- Monitor your credit regularly through free credit report services

- Create and stick to a budget to ensure timely bill payments

- Dispute any errors you find on your credit reports promptly

Tips: Consider setting up credit monitoring alerts to stay informed about any changes to your credit profile.

Impact of a 678 Credit Score on Financial Products

Your 678 credit score will influence the terms and availability of various financial products.

- Mortgages: You’ll likely qualify, but not for the best rates

- Auto loans: Decent rates available, but not the lowest

- Personal loans: Good approval odds with moderate interest rates

- Credit cards: Access to many rewards cards, but may not qualify for premium options

Tips: Always compare offers from multiple lenders to ensure you’re getting the best deal available for your 678 credit score.

Common Misconceptions About a 678 Credit Score

Be aware of these myths surrounding credit scores:

- Myth: Checking your own credit hurts your score

- Misunderstanding: Closing old credit cards always helps your score

- False belief: You need to carry a balance to build credit

Tips: Educate yourself about credit scoring to make informed decisions and avoid actions that could unintentionally harm your 678 credit score.

Conclusion

A 678 credit score puts you in a good position financially. While it offers many advantages, there’s still room for improvement. By understanding the factors that influence your score and implementing the strategies outlined in this article, you can work towards an even better credit score. Remember, a higher credit score can lead to more favorable loan terms, better credit card offers, and increased financial flexibility.

FAQ

Is a 678 credit score good?

A: Yes, a 678 credit score is considered good by most lenders.

How long does it take to improve a 678 credit score?

Improvement can be seen in as little as a few months with consistent positive actions, but significant changes may take 12-24 months.

Can I get a mortgage with a 678 credit score?

Yes, you can generally qualify for a mortgage with a 678 credit score, although you may not receive the best interest rates.

What’s the best way to maintain a 678 credit score?

Make all payments on time, keep credit utilization low, and avoid applying for new credit unnecessarily.

How often should I check my credit score?

It’s advisable to check your credit score at least once a month to monitor changes and detect potential issues early.

![]()