Building credit history is a crucial step in your financial journey. A strong credit history opens doors to better loan terms, lower interest rates, and increased financial opportunities. This guide will walk you through the process of building credit history, from understanding the basics to implementing advanced strategies.

Skale Money Key Takeaways

- Building credit history takes time and consistency

- Responsible use of credit cards is a key factor

- Regular payments and low credit utilization are essential

- Diversifying your credit mix can boost your score

- Regularly monitoring your credit report helps track progress

Table of Contents

Understanding Credit History

Credit history is a record of your past and current credit accounts and how you’ve managed them. It’s the foundation of your financial reputation.

- Components of credit history:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit accounts

- Recent credit inquiries

Credit Score Ranges and Their Meanings:

| Score Range | Rating | Meaning |

| 800-850 | Excellent | Exceptional creditworthiness |

| 740-799 | Very Good | Above-average creditworthiness |

| 670-739 | Good | Average creditworthiness |

| 580-669 | Fair | Below-average creditworthiness |

| 300-579 | Poor | Significant credit risk |

Tips for checking your credit history:

- Request free annual credit reports from major bureaus

- Use credit monitoring services for regular updates

- Review reports carefully for errors or discrepancies

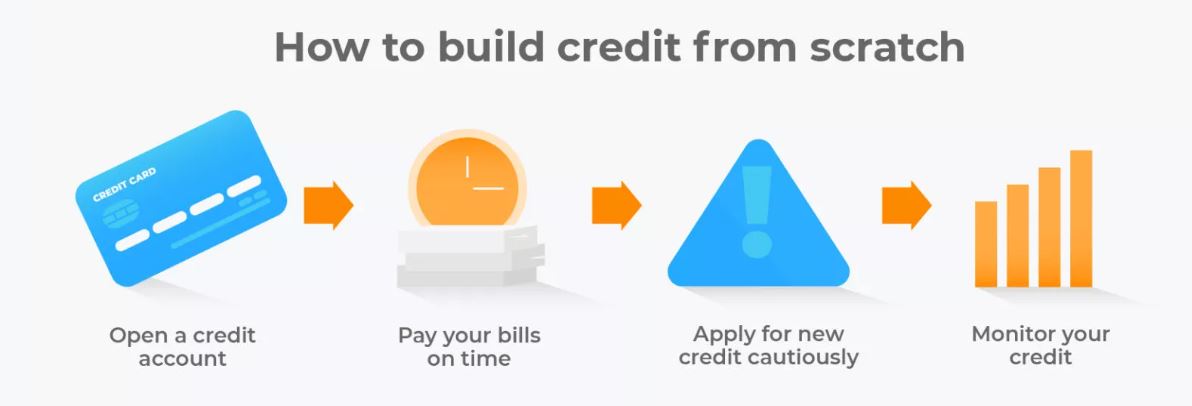

Starting from Scratch: Building Credit for the First Time

For those new to credit, building credit history can seem daunting. However, there are several ways to get started.

- Options for credit newcomers:

- Become an authorized user on someone else’s card

- Apply for a secured credit card

- Consider a credit-builder loan

- Use a co-signer for a loan or credit card

Comparison of Secured Credit Cards:

| Card | Annual Fee | Deposit Required | APR |

| Card A | $0 | $200-$2,500 | 17.99% |

| Card B | $35 | $300-$5,000 | 24.99% |

| Card C | $0 | $200-$1,000 | 22.99% |

Tips for first-time credit users:

- Start small and manageable

- Always pay on time

- Keep credit utilization low

- Be patient and consistent

Credit Cards: A Powerful Tool for Building Credit

Credit cards, when used responsibly, are one of the most effective ways of building credit history.

- Types of credit cards:

- Secured credit cards

- Student credit cards

- Rewards credit cards

- Balance transfer cards

Pros and Cons of Different Credit Card Types:

| Card Type | Pros | Cons |

| Secured | Easy approval, builds credit | Requires deposit, low limits |

| Student | Tailored for students, often no annual fee | May have high interest rates |

| Rewards | Earn points or cashback | May encourage overspending |

| Balance Transfer | Can help pay off debt | Usually require good credit |

Advice for responsible credit card usage:

- Pay your balance in full each month

- Keep utilization below 30%

- Avoid cash advances

- Don’t apply for multiple cards at once

Loans and Their Impact on Credit History

Loans can play a significant role in building credit history, demonstrating your ability to handle different types of credit.

- Types of loans that affect credit:

- Personal loans

- Auto loans

- Mortgages

- Student loans

How Different Loans Impact Credit Scores:

| Loan Type | Impact on Credit Score |

| Personal Loan | Moderate positive impact |

| Auto Loan | Moderate to high positive impact |

| Mortgage | High positive impact |

| Student Loan | Moderate positive impact |

Tips for using loans to build credit:

- Only borrow what you can afford to repay

- Make all payments on time

- Consider a mix of different loan types

- Don’t take out loans solely to build credit

The Role of Payment History in Credit Building

Payment history is the most crucial factor in building credit history, accounting for about 35% of your FICO score.

- Factors affecting payment history:

- On-time payments

- Late payments

- Missed payments

- Collections or charge-offs

Payment History Weight in Different Credit Scoring Models:

| Credit Scoring Model | Payment History Weight |

| FICO Score 8 | 35% |

| VantageScore 3.0 | ~40% |

| FICO Score 9 | 35% |

Strategies for maintaining a positive payment history:

- Set up automatic payments

- Create payment reminders

- Pay at least the minimum due

- Communicate with creditors if you’re having difficulties

Credit Utilization: Balancing Debt and Credit Limits

Credit utilization, or the amount of credit you’re using compared to your limits, is another critical factor in building credit history.

- Factors influencing credit utilization:

- Total credit limit

- Current balances

- Number of cards with balances

- Timing of credit report updates

Ideal Credit Utilization Ratios:

| Credit Score Range | Ideal Utilization Ratio |

| Excellent (800+) | Below 10% |

| Very Good (740-799) | 10-20% |

| Good (670-739) | 20-30% |

| Fair (580-669) | 30-40% |

| Poor (300-579) | Above 40% |

Tips for managing and improving credit utilization:

- Keep balances low on credit cards

- Consider asking for credit limit increases

- Pay card balances before statement closing dates

- Use multiple cards to spread out spending

Length of Credit History: Why Time Matters

The length of your credit history contributes to about 15% of your FICO score and is crucial in building credit history.

- Elements of credit history length:

- Age of oldest account

- Age of newest account

- Average age of all accounts

- How long specific account types have been established

Average Credit History Length by Age Group:

| Age Group | Average Credit History Length |

| 18-24 | 2.9 years |

| 25-34 | 7.1 years |

| 35-44 | 11.2 years |

| 45-54 | 14.7 years |

| 55+ | 18.3 years |

Strategies for building a long-term credit history:

- Keep old accounts open, even if unused

- Limit new credit applications

- Be patient – length improves naturally over time

- Consider keeping your first credit card indefinitely

Diversifying Your Credit Mix

A diverse credit mix can positively impact your credit score and help in building credit history.

- Different types of credit accounts:

- Revolving credit (e.g., credit cards)

- Installment loans (e.g., personal loans, mortgages)

- Open accounts (e.g., charge cards)

Impact of Credit Mix on Credit Scores:

| Credit Mix | Potential Impact on Score |

| Only revolving credit | Moderate |

| Only installment loans | Moderate |

| Mix of revolving and installment | High |

| Mix of revolving, installment, and open | Very High |

Advice for diversifying your credit portfolio safely:

- Don’t open new accounts just for diversity

- Consider different types of credit as needs arise

- Maintain a mix of credit cards and loans if possible

- Remember that payment history and utilization are more important

Conclusion

Building credit history is a journey that requires patience, discipline, and knowledge. By understanding the key components of credit, using credit responsibly, and implementing the strategies outlined in this guide, you can establish and improve your credit history over time. Remember, good credit is built through consistent, responsible financial behavior, not overnight.

FAQ

How long does it take to build a good credit history?

Building a good credit history typically takes at least 6 months to a year of active credit use. However, reaching an excellent credit score can take several years of responsible credit management.

Can I build credit without a credit card?

Yes, you can build credit without a credit card by using credit-builder loans, becoming an authorized user on someone else’s card, or having rent and utility payments reported to credit bureaus.

How often should I check my credit report?

It’s recommended to check your credit report at least once a year. You’re entitled to one free credit report annually from each of the three major credit bureaus.

What’s the difference between a credit score and credit history?

Credit history is a detailed record of your credit accounts and how you’ve managed them. A credit score is a numerical representation of your creditworthiness based on your credit history.

Can bad credit be fixed?

Yes, bad credit can be improved over time through consistent on-time payments, reducing debt, and responsibly managing credit accounts. However, it requires patience and discipline.

![]()