Taking the first step toward homeownership can feel like setting out on an epic journey into unknown territory. The mortgage approval process, while complex, doesn’t have to be overwhelming.

Whether you’re browsing real estate listings or already have a dream home in mind, understanding each step of the mortgage approval process will help you navigate this significant financial decision with confidence.

In this comprehensive guide, we’ll walk you through every stage, from initial application to finally getting those house keys in your hands.

Skale Money Key Takeaways:

- The typical mortgage approval process takes 30-45 days from application to closing

- Essential documentation includes tax returns, pay stubs, bank statements, and employment verification

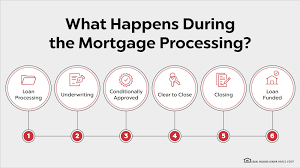

- The process involves multiple stages: pre-qualification, pre-approval, underwriting, and closing

- Common challenges can be avoided with proper preparation and understanding

- Working with experienced professionals can help streamline your approval journey

Table of Contents

Getting Started: Pre-Approval vs. Pre-Qualification

Before diving deep into house hunting, it’s crucial to understand the difference between pre-qualification and pre-approval. These terms are often used interchangeably, but they represent distinct stages in the mortgage approval process.

Pre-qualification is a preliminary step that gives you a general idea of how much you might be able to borrow. During this stage, lenders perform:

- A basic review of your financial situation

- A soft credit check that doesn’t impact your credit score

- A cursory analysis of your income and debt

- An initial assessment of your buying power

Pre-approval, on the other hand, involves a more rigorous evaluation:

- Detailed documentation review

- Thorough income and employment verification

- Asset verification and analysis

- Hard credit check

| Feature | Pre-Qualification | Pre-Approval |

| Time required | 1-3 days | 7-10 days |

| Documentation | Basic | Extensive |

| Credit check | Soft pull | Hard pull |

| Validity period | 30 days | 60-90 days |

| Lending confidence | Low | High |

Preparing Your Financial Documentation

Success in the mortgage approval process heavily depends on proper documentation. Organization is key to avoiding delays and ensuring a smooth experience.

Required documents typically include:

- Federal tax returns from the past two years

- W-2 forms and recent pay stubs (usually last 30 days)

- Bank statements for all accounts (last 2-3 months)

- Investment account statements

- Proof of other income sources

- Photo ID and Social Security number

Self-employed applicants need additional documentation:

- Business tax returns (past two years)

- Profit and loss statements

- Business bank statements

- 1099 forms

- Business license or professional certifications

Pro Tip: Create a digital folder system organized by document type, and keep both electronic and paper copies of everything. This organization will prove invaluable throughout the mortgage approval process.

Understanding Credit Requirements and Impact

Your credit score plays a pivotal role in the mortgage approval process. Lenders use this three-digit number to assess your creditworthiness and determine your interest rate.

Major credit score factors include:

- Payment history (35% of your score)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit applications (10%)

Actions to improve your credit score:

- Pay all bills on time

- Keep credit card balances below 30% of limits

- Avoid opening new credit accounts

- Dispute any errors on your credit report

- Maintain older credit accounts

Types of Mortgages and Choosing the Right One

Understanding different mortgage options is crucial in the mortgage approval process. Each type has its own requirements and benefits.

Conventional loans:

- Typically require higher credit scores (620+)

- Down payments usually 5-20%

- Private mortgage insurance required for down payments under 20%

- Often have competitive interest rates

Government-backed loans: FHA loans:

- Lower credit score requirements (580+)

- Down payments as low as 3.5%

- Higher insurance premiums

VA loans:

- Available to veterans and active military

- No down payment required

- No private mortgage insurance

- Competitive interest rates

USDA loans:

- Available for rural properties

- No down payment required

- Income limitations apply

- Property must be in eligible area

The Underwriting Process Decoded

The underwriting phase is where the real scrutiny of your mortgage approval process begins. Underwriters thoroughly evaluate your application to ensure you meet all lending requirements.

Underwriters review:

- Income stability and sources

- Debt-to-income ratio (typically should be below 43%)

- Asset verification and source of funds

- Property appraisal results

- Credit history and score

- Employment verification

Common underwriting challenges include:

- Unexplained large deposits

- Recent job changes

- Gift funds documentation

- Self-employment income verification

- Previous foreclosures or bankruptcies

Property Appraisal and Home Inspection

A crucial step in the mortgage approval process is evaluating the property’s value and condition.

The appraisal process involves:

- Comparative market analysis

- Property condition assessment

- Location evaluation

- Recent improvements consideration

- Market trends analysis

Home inspection considerations:

- Structural integrity

- Electrical systems

- Plumbing systems

- HVAC functionality

- Roof condition

- Foundation issues

- Pest inspection

Closing Process and Final Steps

The final stage of the mortgage approval process involves several important steps and documents.

Final closing checklist:

- Review closing disclosure

- Conduct final walk-through

- Prepare closing funds

- Gather required identification

- Review all closing documents

- Arrange homeowners insurance

- Schedule closing time and location

Common closing delays to avoid:

- Last-minute credit changes

- Missing documentation

- Insurance delays

- Title issues

- Last-minute property issues

After Approval: Next Steps and Requirements

Once you’ve completed the mortgage approval process, there are several important responsibilities to manage.

Post-closing considerations:

- Set up automatic mortgage payments

- Maintain required insurance coverage

- Plan for property tax payments

- Create a home maintenance schedule

- Keep important documents secure

- Understand your rights and responsibilities

- Plan for regular home maintenance

Conclusion

The mortgage approval process may seem daunting, but breaking it down into manageable steps makes it more approachable. Success depends on preparation, organization, and working with experienced professionals.

Remember that every borrower’s journey is unique, and while challenges may arise, they can usually be overcome with patience and proper guidance. By understanding each step of the process, you’re better equipped to achieve your goal of homeownership.

Frequently Asked Questions

How long does the mortgage approval process typically take?

The entire process usually takes 30-45 days from application to closing, though this can vary based on your situation and market conditions.

What can cause a mortgage application to be denied?

Common reasons include poor credit history, high debt-to-income ratio, insufficient income, employment changes, and property issues discovered during appraisal.

Can I change jobs during the mortgage approval process?

It’s best to avoid job changes during the process. If unavoidable, staying in the same field with similar or higher pay may be acceptable, but consult your lender first.

How much do I need for a down payment?

Down payment requirements vary by loan type, ranging from 0% for VA and USDA loans to 3.5% for FHA loans and typically 5-20% for conventional loans.

What happens if the appraisal comes in low?

You can negotiate with the seller, make up the difference in cash, challenge the appraisal, or cancel the contract if you have an appraisal contingency.

Can I get approved with a low credit score?

Yes, through FHA loans (minimum 580) or with a larger down payment. However, higher credit scores typically result in better interest rates.

Should I pay off debt before applying?

Reducing debt can improve your debt-to-income ratio and chances of approval, but maintain sufficient savings for down payment and closing costs.

What are contingencies and why are they important?

Contingencies are conditions in your purchase contract that protect you if specific requirements aren’t met, such as obtaining financing or satisfactory home inspection results.

![]()