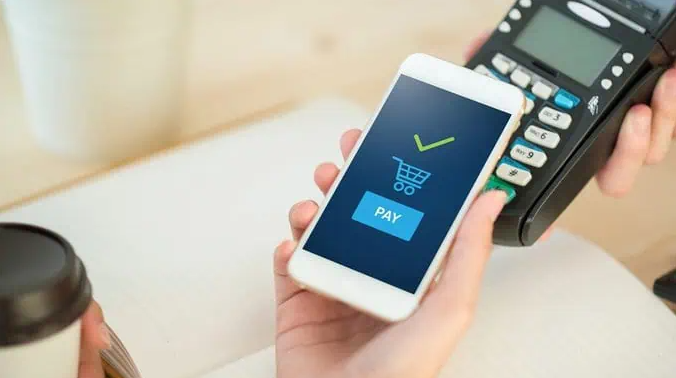

In today’s fast-paced world, mobile payment apps have revolutionized the way we make transactions. These innovative digital tools have simplified the payment process, offering convenience and security at our fingertips.

From contactless NFC payments to peer-to-peer transfers, mobile payment apps have become an integral part of our daily lives. In this comprehensive guide, we’ll demystify the world of mobile payments and explore everything you need to know about these cutting-edge financial technologies.

Skale Money Key Takeaways

- Mobile payment apps are software applications that enable users to make electronic payments securely through their smartphones or mobile devices, often by linking to a digital wallet or virtual account.

- Popular mobile payment apps include digital wallets like Apple Pay, Google Pay, and Samsung Pay that use NFC technology for contactless payments at physical merchants.

- Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle facilitate direct fund transfers between users without involving banks or credit cards.

- For businesses, dedicated merchant mobile payment apps like Square, PayPal Here, and Clover provide affordable solutions for accepting mobile payments from customers.

- While many mobile payment apps charge fees, especially for businesses, some like Venmo and Cash App offer free personal peer-to-peer payment services (with potential limitations).

Table of Contents

What are Mobile Payment Apps?

Mobile payment apps are software applications designed for smartphones and other mobile devices that enable users to make payments electronically. These apps typically leverage digital wallets or virtual accounts linked to a user’s bank account, credit card, or other payment methods.

By integrating with various payment gateways, mobile payment apps facilitate secure and seamless transactions, eliminating the need for physical cash or cards.

The most popular examples of mobile payment apps include:

- Apple Pay

- Google Pay

- Samsung Pay

They are widely accepted by millions of merchants worldwide. These contactless payment methods use Near Field Communication (NFC) technology, allowing users to simply hold their mobile device near a compatible payment terminal to complete a transaction.

Types of Mobile Payment Apps

The realm of mobile payment apps encompasses a diverse range of solutions tailored to different needs and preferences. Here are some of the main categories:

- In-app mobile wallets: These apps, such as Apple Pay, Google Pay, and Samsung Pay, are integrated into the operating systems of smartphones, providing a seamless payment experience.

- Peer-to-peer (P2P) payment apps: Apps like Venmo, Cash App, and Zelle enable users to transfer funds directly to friends, family, or service providers without involving a bank or credit card.

- Mobile banking apps: Many traditional banks and financial institutions offer mobile apps that incorporate payment functionalities, allowing customers to manage their accounts and make payments on the go.

- Mobile payment apps for merchants: Solutions like Square, PayPal Here, and Clover cater specifically to businesses, enabling them to accept mobile payments from customers securely and efficiently.

Mobile Payment Apps for Small Businesses

Mobile payment apps have become a game-changer for small businesses, offering affordable and flexible payment solutions. By integrating mobile payment integration for businesses, entrepreneurs can accept payments from customers using their smartphones or tablets, eliminating the need for expensive point-of-sale systems.

Some of the best mobile payment apps 2024 for small businesses include:

- Square

- PayPal Here

- Clover

These apps provide user-friendly interfaces, competitive transaction fees, and robust security features, making them ideal for businesses of all sizes.

Mobile Payment Apps UK

The United Kingdom has embraced mobile payments with open arms, and a variety of mobile payment apps have gained popularity among British consumers and businesses. Apple Pay, Google Pay, and Samsung Pay are widely accepted across the UK, offering a convenient contactless payment method for everyday transactions.

Additionally, apps like PayPal and Revolut have gained traction in the UK market, catering to both personal and business needs. The UK’s thriving fintech ecosystem has fostered innovation in mobile payments, making it easier for consumers and merchants to adopt these cutting-edge technologies.

Mobile Payment Apps for Merchants

For merchants and businesses of all sizes, dedicated mobile payment apps offer a range of benefits and features. Apps like Square, PayPal Here, and Clover provide powerful tools for accepting payments, managing inventory, tracking sales, and generating reports.

These mobile payment apps for merchants typically offer competitive transaction fees, robust security measures, and seamless integration with existing point-of-sale systems or e-commerce platforms.

Embracing these solutions enables merchants to streamline their payment processes, enhance customer experiences, and stay competitive in an increasingly digital marketplace.

Free Mobile Payment Apps

While many mobile payment apps charge fees or require subscriptions, there are also several free mobile payment apps available for personal and business use. Apps like Venmo, Cash App, and Zelle allow users to transfer funds to friends, family, or service providers without incurring any fees (for personal transactions).

It’s important to note that while these free mobile payment apps may not charge for basic services, they may have limitations or additional fees for advanced features or business transactions.

Nonetheless, they offer a convenient and cost-effective solution for those seeking a simple way to manage personal finances or facilitate peer-to-peer payments.

Conclusion

Mobile payment apps have become an indispensable tool for consumers and businesses alike. Whether you’re looking for a convenient way to make purchases, split bills with friends, or accept payments as a merchant, the world of mobile payments offers a wealth of options to suit your needs.

As technology continues to evolve, we can expect mobile payment trends in 2024 to bring even more innovative solutions and features, further enhancing the user experience and security of these platforms.

Embracing mobile payment apps not only simplifies your financial transactions but also positions you at the forefront of the digital revolution, empowering you to stay ahead of the curve.

FAQs

Are mobile payment apps secure?

Yes, reputable mobile payment apps employ robust security measures, such as mobile wallet security features like encryption, biometric authentication, and tokenization, to protect your financial information and transactions.

Do I need a special device to use mobile payment apps?

No, most mobile payment apps are designed to work with modern smartphones and tablets, allowing you to make payments using the devices you already own.

How do contactless payment methods like Apple Pay and Google Pay work?

These apps leverage NFC payment technology to facilitate contactless transactions. When you hold your device near a compatible payment terminal, the app securely transmits your payment information, allowing you to complete the purchase without physical contact.

Can I use mobile payment apps for peer-to-peer transfers?

Absolutely! Apps like Venmo, Cash App, and Zelle are designed specifically for peer-to-peer mobile payments, allowing you to send and receive money from friends, family, or service providers directly through the app.

Are there any fees associated with using mobile payment apps?

While many mobile payment apps are free for personal use, some may charge transaction fees or subscription fees, especially for business or merchant accounts. It’s essential to review the fee structure and terms of each app to understand the associated costs.

![]()