Credit utilization ratio is a critical factor in determining your credit score and overall financial health. This ratio represents the amount of credit you’re using compared to your total available credit. In this article, we’ll explore what credit utilization ratio means, why it’s important, and how you can manage it effectively to improve your credit standing.

Skale Money Key Takeaways

- Credit utilization ratio is the percentage of your available credit that you’re currently using.

- It significantly impacts your credit score, accounting for about 30% of the FICO score calculation.

- Lower credit utilization ratios generally indicate better credit management.

- Experts recommend keeping your credit utilization ratio below 30%.

- Both overall and per-card utilization ratios are important.

Table of Contents

Understanding Credit Utilization Ratio

Introduction: Credit utilization ratio is a key metric in assessing creditworthiness. It’s calculated by dividing your current credit card balances by your total credit limits. This ratio provides lenders with insight into how you manage your available credit, which can influence your ability to secure loans and obtain favorable interest rates.

Components of credit utilization ratio

- Total credit card balances

- Total credit limits across all cards

- Individual card utilization

- Overall utilization across all cards

- Revolving credit accounts (e.g., credit cards, lines of credit)

Table: Example calculation of credit utilization ratio

| Card | Credit Limit | Current Balance | Individual Utilization |

| A | $5,000 | $1,000 | 20% |

| B | $3,000 | $900 | 30% |

| C | $2,000 | $200 | 10% |

| Total | $10,000 | $2,100 | 21% (Overall) |

Tips and advice: How to interpret your credit utilization ratio

- Aim to keep your overall credit utilization ratio below 30%.

- Monitor both individual card utilization and overall utilization.

- Lower ratios generally indicate better credit management.

- High utilization on a single card can negatively impact your score.

- Consistently high utilization may signal financial stress to lenders.

- Improving your ratio can quickly boost your credit score.

- Consider utilization before closing unused credit cards.

- Regular payments and keeping balances low are key to a healthy ratio.

How Credit Utilization Affects Your Credit Score

Credit utilization ratio plays a significant role in determining your credit score. It’s the second most important factor after payment history, accounting for about 30% of your FICO score. Understanding how utilization impacts your score can help you make informed decisions about your credit use.

Credit score factors influenced by utilization

- Overall credit score

- Credit mix and types of credit used

- Length of credit history

- New credit applications

- Payment history (indirectly)

Table: Credit score ranges and corresponding utilization ratios

| Credit Score Range | Recommended Utilization Ratio |

| 800-850 (Excellent) | Less than 10% |

| 740-799 (Very Good) | 10-20% |

| 670-739 (Good) | 20-30% |

| 580-669 (Fair) | 30-50% |

| Below 580 (Poor) | Over 50% |

Tips and advice: Optimal credit utilization for different credit situations

- For the best scores, aim for utilization under 10%.

- If rebuilding credit, focus on keeping utilization under 30%.

- Balance transfer cards can help lower utilization temporarily.

- Consider your utilization before applying for new credit.

- Pay attention to reporting dates to showcase lower utilization.

Calculating Your Credit Utilization Ratio

Calculating your credit utilization ratio is a straightforward process that can provide valuable insights into your credit health. By regularly monitoring this ratio, you can take proactive steps to manage your credit effectively and improve your credit score.

Steps to calculate credit utilization

- Gather current balances for all credit cards

- Collect credit limits for all cards

- Calculate individual card utilization

- Sum up total balances and credit limits

- Divide total balance by total credit limit

- Multiply by 100 to get the percentage

Table: Sample credit utilization calculation for multiple cards

| Card | Credit Limit | Current Balance | Individual Utilization |

| A | $5,000 | $1,500 | 30% |

| B | $3,000 | $600 | 20% |

| C | $2,000 | $100 | 5% |

| Total | $10,000 | $2,200 | 22% (Overall) |

Tips and advice: Tools and resources for tracking credit utilization

- Use credit monitoring services for real-time updates.

- Check your credit card statements regularly.

- Utilize personal finance apps that track credit utilization.

- Set up balance alerts on your credit cards.

- Create a spreadsheet to manually track your utilization.

Ideal Credit Utilization Ratio

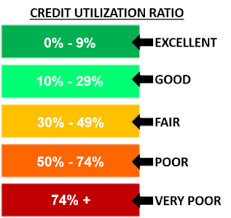

While there’s no universally perfect credit utilization ratio, financial experts generally agree on certain ranges that are considered ideal. Understanding these recommendations can help you set goals for managing your credit utilization and improving your credit score.

Different expert opinions on ideal ratios

- FICO recommends keeping utilization below 30%

- VantageScore suggests 30% or lower is good

- Some credit experts advise aiming for 10% or less

- The “AZEO” method recommends 0% on all but one card

- Some suggest 1-10% utilization for optimal scores

Table: Comparison of credit score impacts at various utilization levels

| Utilization Level | Potential Impact on Credit Score |

| 0% | Slight negative impact |

| 1-10% | Optimal positive impact |

| 11-30% | Moderate positive impact |

| 31-50% | Slight negative impact |

| Above 50% | Significant negative impact |

Tips and advice: Strategies to maintain an ideal ratio

- Set up automatic payments to keep balances low.

- Use multiple cards to spread out expenses.

- Request credit limit increases to lower utilization.

- Pay off balances before statement closing dates.

- Consider using a personal loan to consolidate high-interest debt.

Strategies to Lower Your Credit Utilization Ratio

Lowering your credit utilization ratio can have a positive impact on your credit score. There are several strategies you can employ to reduce your utilization and improve your overall credit health. Let’s explore some effective methods to achieve this goal.

Methods to reduce credit utilization

- Pay down existing credit card balances

- Request credit limit increases

- Open a new credit card

- Make multiple payments per month

- Use a personal loan for debt consolidation

- Keep old credit cards open

- Use a mix of credit cards and charge cards

Table: Pros and cons of different reduction strategies

| Strategy | Pros | Cons |

| Pay down balances | Direct impact, improves habits | Requires available funds |

| Request limit increase | Quick fix, no new accounts | May result in hard inquiry |

| Open new card | Increases available credit | Temporary score dip, temptation |

| Multiple monthly payments | Keeps utilization low | Requires discipline |

| Personal loan consolidation | Fixed payments, lower interest | May incur fees, new debt |

Tips and advice: Quick wins for lowering credit utilization

- Pay off small balances completely.

- Time your payments before statement closing dates.

- Use windfall money (tax returns, bonuses) to pay down balances.

- Consider balance transfer offers for high-interest debt.

- Use cash or debit for small purchases to avoid increasing utilization.

Credit Utilization Myths Debunked

There are many misconceptions surrounding credit utilization ratio that can lead to poor credit management decisions. It’s important to separate fact from fiction to make informed choices about your credit use and improve your credit score effectively.

Popular myths about credit utilization

- Carrying a balance improves your credit score

- Closing unused cards always helps your credit

- Only your overall utilization matters

- Utilization doesn’t matter if you pay in full

- High utilization permanently damages your score

- All types of credit accounts affect utilization equally

Table: Myths vs. Facts

| Myth | Fact |

| Carrying a balance improves your score | Paying in full is better for your score |

| Closing unused cards helps your credit | Closing cards can increase utilization ratio |

| Only overall utilization matters | Both overall and per-card utilization count |

| Utilization doesn’t matter if you pay in full | Utilization matters regardless of payment |

| High utilization causes permanent damage | Utilization has no memory in scoring models |

Tips and advice: How to separate fact from fiction in credit advice

- Consult reputable financial sources and credit bureaus.

- Be wary of advice that sounds too good to be true.

- Understand that credit scoring models evolve over time.

- Consider the source of the advice and potential biases.

- Test advice on your own credit (within reason) to see results.

The Relationship Between Credit Limit Increases and Utilization

Credit limit increases can have a significant impact on your credit utilization ratio. Understanding this relationship can help you make strategic decisions about when and how to request limit increases to improve your credit standing.

Factors affecting credit limit increases

- Payment history

- Length of credit history

- Income

- Current credit utilization

- Overall creditworthiness

- Economic conditions

- Issuer’s policies

Table: Example of how a credit limit increase affects utilization

| Scenario | Credit Limit | Balance | Utilization |

| Before increase | $5,000 | $1,500 | 30% |

| After 20% increase | $6,000 | $1,500 | 25% |

| After 50% increase | $7,500 | $1,500 | 20% |

Tips and advice: When and how to request a credit limit increase

- Wait at least 6-12 months between requests.

- Time requests after income increases or credit score improvements.

- Be prepared to provide updated income information.

- Consider requesting increases on cards with the highest utilization first.

- Be cautious of hard inquiries that may temporarily lower your score.

Credit Utilization for Different Types of Credit Accounts

Credit utilization is primarily associated with revolving credit accounts like credit cards. However, different types of credit accounts can impact your overall credit profile in various ways. Understanding how utilization is calculated for different account types can help you manage your credit more effectively.

How utilization is calculated for different accounts

- Credit cards (revolving accounts)

- Personal lines of credit

- Home equity lines of credit (HELOCs)

- Installment loans (e.g., mortgages, auto loans)

- Charge cards

- Store credit cards

Table: Comparison of utilization impact across account types

| Account Type | Utilization Calculated? | Impact on Credit Score |

| Credit Cards | Yes | High |

| Personal Lines | Yes | High |

| HELOCs | Yes | Moderate |

| Installment Loans | No | Low (balance vs. original) |

| Charge Cards | Varies by model | Low to Moderate |

| Store Credit Cards | Yes | High |

Tips and advice: Managing utilization across multiple account types

- Focus on revolving credit utilization for the biggest impact.

- Don’t neglect installment loans; timely payments are crucial.

- Be cautious with store cards, as they often have low limits.

- Consider the impact of HELOCs on your overall debt profile.

- Use a mix of credit types to demonstrate creditworthiness.

Monitoring Your Credit Utilization Over Time

Regularly monitoring your credit utilization ratio is crucial for maintaining good credit health. By keeping track of your utilization over time, you can identify trends, anticipate potential issues, and take proactive steps to improve your credit score.

Methods to track credit utilization

- Credit monitoring services

- Credit card issuer websites and apps

- Personal finance management tools

- Spreadsheets or budgeting software

- Regular credit report checks

- Setting up account alerts

Table: Sample credit utilization tracking sheet

| Month | Card A | Card B | Card C | Total Balance | Total Limit | Overall Utilization |

| January | 25% | 30% | 15% | $2,100 | $10,000 | 21% |

| February | 20% | 25% | 10% | $1,700 | $10,000 | 17% |

| March | 15% | 20% | 5% | $1,300 | $10,000 | 13% |

Tips and advice: How often to check and what changes to look for

- Check your utilization at least monthly, ideally before statement closing dates.

- Look for sudden spikes in utilization that might indicate overspending.

- Monitor for gradual increases that could suggest lifestyle inflation.

- Pay attention to changes in credit limits that affect your ratio.

- Set personal utilization targets and track progress towards them.

Conclusion

Managing your credit utilization ratio is a powerful way to improve and maintain a good credit score. By understanding how this ratio is calculated, what factors influence it, and how to monitor it effectively, you can take control of your credit health.

Remember that credit utilization has no memory in most scoring models, so positive changes can quickly impact your score. Keep your utilization low, monitor it regularly, and make informed decisions about your credit use to achieve and maintain a strong credit profile.

FAQ

How often is my credit utilization ratio updated?

Credit card issuers typically report to credit bureaus monthly, often on your statement closing date.

Does paying my credit card balance in full every month guarantee a low utilization ratio?

Not necessarily. Your utilization is typically calculated based on the balance reported to credit bureaus, which is often your statement balance.

Can having a 0% utilization ratio negatively impact my credit score?

While rare, some scoring models may slightly penalize a 0% utilization as it doesn’t demonstrate active credit management. Aim for 1-10% for optimal results.

How quickly will paying down my balances improve my credit score?

You may see improvements as soon as the lower balances are reported to the credit bureaus, typically within 30-45 days.

Should I close unused credit cards to improve my credit utilization?

Generally, no. Closing unused cards reduces your available credit, potentially increasing your overall utilization ratio.

![]()