Are you tired of living paycheck to paycheck and dreaming of financial freedom? You’re not alone. Millions have found their path to financial success through savings strategies by Dave Ramsey, and today, we’re going to explore every aspect of these life-changing principles.

Whether you’re just starting your financial journey or looking to refine your approach, this comprehensive guide will walk you through Dave Ramsey’s tried-and-true methods for building wealth and securing your financial future.

Skale Money Key Takeaways

Before diving deep into Dave Ramsey’s savings strategies, let’s highlight what you can expect to learn:

- Build a solid emergency fund within 3-6 months

- Implement a zero-based budget that maximizes savings

- Follow the 7 Baby Steps to financial freedom

- Save 15% of your income for retirement

- Create multiple savings streams for various life goals

- Expected time to see results: 18-24 months for initial success

- Success rate: Over 80% of people who strictly follow these principles report significant financial improvement

Table of Contents

1. Understanding Savings Strategies by Dave Ramsey: Savings Principles

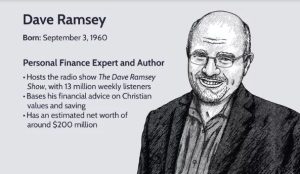

The foundation of Dave Ramsey’s savings strategies begins with understanding his core philosophy about money. At its heart, his approach emphasizes personal responsibility, intentional living, and the power of focused determination.

Key principles include:

- Living on less than you earn

- Avoiding all forms of debt

- Building wealth slowly and steadily

- Creating and sticking to a written budget

- Using cash for discretionary spending

- Saving with a purpose

- Investing for the long term

2. Building Your Emergency Fund: The First Step to Financial Security

Your emergency fund is your financial safety net, and it’s the cornerstone of Dave Ramsey’s savings strategies. Starting with a basic $1,000 emergency fund might seem small, but it’s your first line of defense against life’s unexpected challenges.

Steps to build your emergency fund:

- Save $1,000 as quickly as possible (Baby Step 1)

- Cut unnecessary expenses

- Sell items you don’t need

- Take on temporary extra work

- Work toward 3-6 months of expenses (Baby Step 3)

Emergency Fund Calculator:

| Monthly Expenses | 3 Months | 6 Months |

| $3,000 | $9,000 | $18,000 |

| $4,000 | $12,000 | $24,000 |

| $5,000 | $15,000 | $30,000 |

3. The Debt Snowball Method and Saving

Before maximizing your savings potential, you need to eliminate the debt that’s eating away at your income. The Debt Snowball method is a crucial component of Dave Ramsey’s savings strategies, designed to help you become debt-free as quickly as possible.

How to implement the Debt Snowball:

- List all debts from smallest to largest

- Pay minimum payments on all debts

- Put extra money toward smallest debt

- Once smallest is paid, roll that payment to next debt

- Maintain momentum until debt-free

- Celebrate small victories along the way

4. Budgeting Strategies for Maximum Savings

A proper budget is the engine that drives Dave Ramsey’s savings strategies. The zero-based budget ensures every dollar has a purpose, including saving for your future.

Recommended Budget Percentages:

| Category | Percentage |

| Housing | 25% |

| Utilities | 10% |

| Food | 10-15% |

| Transportation | 10% |

| Health | 5-10% |

| Insurance | 10-15% |

| Savings | 15% |

| Entertainment | 5-10% |

| Miscellaneous | 5-10% |

5. Retirement Savings: The Ramsey Way

According to Dave Ramsey’s savings strategies, retirement planning becomes a priority after establishing your emergency fund and becoming debt-free. His approach emphasizes consistent, long-term investing through tax-advantaged accounts.

Retirement savings guidelines:

- Invest 15% of household income

- Focus on growth stock mutual funds

- Maximize employer match in 401(k)

- Utilize Roth IRA options

- Avoid taking on debt for investments

- Stay invested for the long term

- Diversify across four types of mutual funds

6. Saving for Major Life Goals

Once you’ve established your emergency fund and retirement savings, it’s time to focus on other significant life goals. Dave Ramsey’s savings strategies emphasize saving with purpose and intention.

Priority savings categories:

- Down payment for home purchase (20% minimum)

- Children’s college education (ESA or 529 plans)

- Vehicle replacement fund

- Home repairs and maintenance

- Vacation and travel

- Special occasions and gifts

7. Advanced Savings Strategies

For those who have mastered the basics, Dave Ramsey’s savings strategies include advanced techniques for building wealth and protecting assets.

Advanced saving techniques:

- Real estate investment considerations

- Business emergency funds

- High-yield savings accounts

- Insurance strategies

- Estate planning

- Tax-efficient investing

- Charitable giving

8. Common Savings Mistakes and How to Avoid Them

Understanding common pitfalls can help you stay on track with Dave Ramsey’s savings strategies.

Mistakes to avoid:

- Not having a written budget

- Skipping the emergency fund

- Trying to pay off debt while saving

- Investing before becoming debt-free

- Keeping too much in savings

- Not adjusting for life changes

- Forgetting to account for inflation

9. Technology and Tools for Implementing Ramsey’s Strategies

Modern technology makes it easier than ever to implement Dave Ramsey’s savings strategies effectively.

Recommended tools:

- EveryDollar budgeting app

- Automated savings transfers

- Expense tracking apps

- Investment monitoring tools

- Debt payoff calculators

- Net worth tracking software

- Budget percentage calculators

Conclusion

Dave Ramsey’s savings strategies have helped millions of people transform their financial lives. By following these principles – starting with a solid emergency fund, eliminating debt, budgeting effectively, and saving consistently – you can build a strong financial future.

Remember, the journey to financial peace is a marathon, not a sprint. Stay focused on your goals, celebrate small victories, and keep moving forward one step at a time.

FAQ Section

How long does it take to save a full emergency fund?

On average, it takes 18-24 months to save a full 3-6 month emergency fund, but this varies based on income and expenses.

Can I save and pay off debt at the same time?

Dave Ramsey recommends saving $1,000 first, then focusing entirely on debt payoff before building your full emergency fund.

What if I can’t save 15% for retirement right away?

Start with what you can, but make it a priority to increase your retirement savings as you become debt-free and improve your income.

How do I stay motivated during the saving process?

Set small, achievable goals, track your progress, and connect with others following Dave Ramsey’s principles through Financial Peace University or online communities.

Should I use a financial advisor?

Dave Ramsey recommends working with a financial advisor, particularly for retirement planning and complex investment decisions.

What about saving for children’s college?

College savings should come after your emergency fund is complete, you’re debt-free, and you’re investing 15% for retirement.

Additional Resources

To further your understanding of Dave Ramsey’s savings strategies, consider these resources:

- “The Total Money Makeover” by Dave Ramsey

- Financial Peace University courses

- The Ramsey Show podcast

- EveryDollar budgeting app

- Local Financial Peace University classes

- Ramsey Solutions YouTube channel

Remember, the key to success with Dave Ramsey’s savings strategies is consistency and commitment. Start where you are, follow the Baby Steps in order, and trust the process that has helped millions achieve financial peace.

![]()