If you’re struggling to manage your finances and achieve your financial goals, the [50/30/20 rule] might be the solution you’ve been looking for. This simple yet effective budgeting strategy can help you take control of your money and build a solid foundation for long-term financial success.

Following the principle of paying yourself first, you can ensure that your hard-earned money is working for you, not against you.

Skale Money Key Takeaways

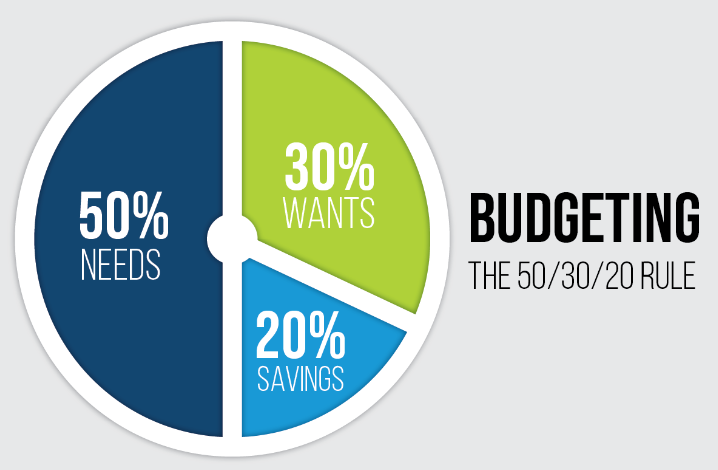

- Budget Allocation: The 50/30/20 rule divides your income into three categories: 50% for needs (essential expenses), 30% for wants (discretionary spending), and 20% for savings and debt repayment.

- Needs (50%): Essential expenses include housing, utilities, groceries, transportation, minimum debt payments, child care, and healthcare costs. This ensures your basic living expenses and financial obligations are covered.

- Wants (30%): Discretionary spending covers dining out, entertainment, subscriptions, hobbies, travel, clothing beyond necessities, and gifts. This allows room for personal enjoyment and lifestyle preferences.

- Savings (20%): Savings include emergency fund contributions, retirement accounts, debt repayment beyond minimums, investments, and other long-term financial goals. This helps build financial security and prepare for the future.

- Flexibility and Adjustments: The rule provides a flexible framework that can be adjusted based on individual circumstances such as income level, cost of living, and financial obligations. It’s important to find a balance that suits your specific needs and goals.

Table of Contents

What is the 50/30/20 Budget Rule?

The 50/30/20 rule is a simple and effective budgeting strategy that helps you allocate your income into three main categories: needs, wants, and savings. Following this rule, you can ensure that your essential expenses are covered, while still allowing room for discretionary spending and saving for the future.

50% for Needs

The first and most significant portion of the 50/30/20 rule is dedicated to your essential expenses, also known as “needs.” This category accounts for 50% of your monthly income and includes all the necessities that you can’t live without, such as:

- Housing (rent/mortgage payments)

- Utilities (electricity, water, gas, internet)

- Groceries and household supplies

- Transportation (car payments, insurance, gas, public transportation)

- Minimum debt payments (student loans, credit cards)

- Child care expenses

- Healthcare costs (insurance premiums, medications)

The “needs” category is designed to cover your basic living expenses and any financial obligations that you must fulfill. Allocating half of your income to this category ensures that your essential needs are met before allocating funds to other areas.

30% for Wants

The second component of the 50/30/20 rule is the “wants” category, which accounts for 30% of your monthly income. This portion is dedicated to discretionary spending, or the expenses that you choose to incur for personal enjoyment or lifestyle preferences. Examples of “wants” include:

- Dining out and entertainment (movies, concerts, etc.)

- Subscriptions (streaming services, gym memberships)

- Hobbies and recreational activities

- Vacations and travel

- Clothing and personal care (beyond basic necessities)

- Gifts and donations

The “wants” category is where you can indulge in the things that bring you joy and enhance your quality of life. However, it’s important to remember that these expenses are not essential and should be carefully managed to avoid overspending.

20% for Savings

The final component of the 50/30/20 rule is the “savings” category, which accounts for 20% of your monthly income. This portion is dedicated to building your financial security and preparing for the future. The “savings” category can include:

- Emergency fund contributions

- Retirement account contributions (401(k), IRA, etc.)

- Debt repayment (beyond minimum payments)

- Investment contributions (stocks, mutual funds, etc.)

- Short-term and long-term savings goals (down payment for a house, education fund, etc.)

Allocating 20% of your income towards savings and investments, makes you build a solid financial foundation and work towards achieving your long-term goals. This category is often overlooked or neglected, but it’s crucial for ensuring your financial well-being and preparing for unexpected expenses or future opportunities.

The 50/30/20 rule provides a simple and straightforward framework for managing your finances effectively. By adhering to this breakdown, you ensure that your essential needs are met, while still allowing room for discretionary spending and saving for the future. Remember, the key to success with this budgeting strategy is finding the right balance that works for your specific circumstances and financial goals.

To better understand how the [50/30/20 rule] works in practice, let’s consider a few examples:

- Needs (50%): If your monthly income is $4,000, you would allocate $2,000 towards essential expenses like rent ($1,200), utilities ($200), groceries ($400), and transportation ($200).

- Wants (30%): With $1,200 allocated for this category, you could spend $300 on dining out, $400 on entertainment (streaming services, gym membership, etc.), and $500 on hobbies or other discretionary purchases.

- Savings (20%): The remaining $800 would go towards your savings goals, such as an emergency fund, retirement account, or other investments.

Is the 50/30/20 Rule Realistic?

While the 50/30/20 rule provides a solid framework for budgeting, it’s important to recognize that it may not be a perfect fit for everyone’s situation. Factors like your income level, cost of living, and financial obligations can impact the feasibility of strictly adhering to this breakdown.

For example, if you live in a high-cost area or have significant debt, allocating 50% of your income to needs might be challenging. In such cases, you may need to adjust the percentages or prioritize certain expenses over others.

However, the beauty of the 50/30/20 rule lies in its flexibility. You can use it as a starting point and tweak the numbers to better suit your circumstances. The key is to maintain the overall principle of balancing your spending between needs, wants, and savings.

50/30/20 Budget Template

To help you get started with the 50/30/20 rule, there are downloadable 50/30/20 budget templates that you can download and use to track your income and expenses. This 50/30/20 budget spreadsheet will make it easier to visualize your spending patterns and ensure that you’re sticking to the recommended percentages.

Alternatively, you can also use a 50/30/20 budget calculator to automatically allocate your income based on the rule’s breakdown.

FAQs:

According to the 50/30/20 rule, what percentage of your income should you allocate to needs, wants, and savings?

The 50/30/20 rule recommends allocating 50% of your income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings and debt repayment.

Should the 50/30/20 rule be applied before or after taxes?

It’s generally recommended to apply the 50/30/20 rule to your net income, which is the amount you receive after taxes and other deductions have been taken out. This way, you’re budgeting based on the actual money you have available to spend and save.

What if my essential expenses (needs) exceed 50% of my income?

If your essential expenses consistently exceed 50% of your income, you may need to adjust the percentages or find ways to reduce your fixed costs. This could involve downsizing your living situation, negotiating lower rates for utilities, or cutting back on non-essential expenses.

Can I allocate more than 30% to the “wants” category?

While the 50/30/20 rule recommends allocating 30% to discretionary spending, you can adjust this percentage based on your priorities and lifestyle. However, it’s important to ensure that you’re still setting aside enough for savings and not compromising your long-term financial goals.

How can I stay motivated and stick to the 50/30/20 rule?

Staying motivated can be challenging, but setting specific financial goals and tracking your progress can help. Consider using budgeting apps or tools to monitor your spending and celebrate small victories along the way. Additionally, involving your family or friends in the process can provide accountability and support.

Conclusion:

The 50/30/20 rule is a simple yet powerful budgeting strategy that can help you take control of your finances and achieve long-term financial stability. By allocating your income strategically and prioritizing savings, you can create a solid foundation for your future goals, whether it’s building an emergency fund, paying off debt, or saving for retirement.

While the rule may require some adjustments based on your individual circumstances, the principles of balancing your spending, living within your means, and saving for the future remain fundamental to achieving financial success.

Start implementing the 50/30/20 rule today by downloading a free budget template or using a budget calculator. Remember, small changes can lead to big results over time. Take the first step towards a better financial future, and watch as the 50/30/20 rule transforms your relationship with money.

Author: Cosmas Mwirigi

Cosmas Mwirigi is an established freelance writer with over five years of experience and the founder of Skalemoney.com. His content has been published by multiple publishers, including PV-Magazine, Slidebean, Bridge Global, Casinos.com, Gambling.com, and Reverbico. Mwirigi is an expert writer in iGaming, B2B, SaaS, Finance, digital marketing and Solar renewable energy. To contact him for his services, connect with him on his LinkedIn.

![]()