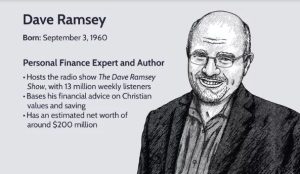

In the landscape of personal finance, few names carry as much weight and influence as Dave Ramsey, the financial guru who has revolutionized how millions of Americans approach money management.

From the depths of personal financial ruin to becoming a beacon of financial wisdom, Dave Ramsey’s journey is a testament to resilience, education, and the power of sound financial principles.

This comprehensive biography delves into the life of a man who transformed his own financial failures into a mission to help others achieve financial freedom.

Skale Money Key Takeaways

Dave Ramsey’s journey offers profound insights into personal finance and resilience:

- Financial recovery is possible with the right mindset and systematic approach

- Debt is a significant obstacle to financial freedom that can be systematically eliminated

- Personal values and financial decisions are deeply interconnected

- Continuous financial education is crucial for long-term wealth building

- Psychological aspects of money management are as important as numerical Calculations

Table of Contents

Early Life and Background

Dave Ramsey’s story begins in the heart of Tennessee, where the seeds of his future financial philosophy were first planted.

Born on September 3, 1960, in Antioch, Tennessee, Ramsey grew up in a middle-class family environment that would significantly shape his understanding of money and personal responsibility.

Key highlights of his early life include:

- A childhood in Tennessee that emphasized hard work and personal initiative

- Early signs of entrepreneurial spirit and financial curiosity

- Graduation from the University of Tennessee with a degree in Finance and Real Estate

- Early exposure to business and investment concepts through his family and educational background

From a young age, Ramsey demonstrated an unusual interest in financial matters. Unlike many of his peers, he wasn’t content with simply understanding money – he wanted to master it.

His academic background in finance and real estate provided him with a solid theoretical foundation, but his true education would come from real-world experiences.

The Rise and Fall: First Financial Journey

The most transformative period of Dave Ramsey’s life came in his mid-twenties, a time of explosive success followed by a catastrophic financial collapse. This chapter of his life would become the crucible that forged his now-famous financial philosophy.

Notable experiences:

- Rapid success in real estate investment by his early twenties

- Building a multi-million dollar real estate portfolio

- Experiencing a complete financial bankruptcy that stripped away everything

- Learning invaluable lessons about debt, risk, and financial management

At the height of his initial success, Ramsey seemed unstoppable. He had leveraged aggressive real estate strategies and accumulated significant wealth.

However, when the banking industry experienced major changes, his entire financial empire came crashing down. The banks called his notes, and within a short period, he lost everything – a devastating blow that would have crushed many individuals.

Turning Point: Developing the Ramsey Philosophy

The financial collapse became Ramsey’s most significant turning point. Instead of giving up, he embarked on an intensive journey of financial education and personal transformation.

During this period, he began to develop the principles that would later make him a household name in personal finance.

Key development areas:

- Comprehensive research into personal financial management

- Integration of biblical principles with practical financial advice

- Development of the revolutionary “Debt Snowball” method

- Creation of systematic approaches to financial planning and wealth building

Ramsey didn’t just study financial principles; he lived them. He began to develop a holistic approach to money management that went beyond mere numbers.

His philosophy integrated practical financial strategies with personal responsibility and moral principles, often drawing from biblical teachings about stewardship and financial wisdom.

The Seven Baby Steps

Dave Ramsey’s most significant contribution to personal finance is his “Seven Baby Steps” method. This systematic approach has become a blueprint for financial recovery and wealth building for millions of people.

The Seven Baby Steps:

- Save $1,000 for your starter emergency fund

- Pay off all debt using the debt snowball method

- Save 3-6 months of expenses in a fully funded emergency fund

- Invest 15% of income in retirement accounts

- Save for children’s college fund

- Pay off home early

- Build wealth and give

Each step is designed to be sequential and achievable, breaking down complex financial recovery into manageable actions. The brilliance of the Baby Steps lies in their simplicity and psychological approach – each completed step provides motivation for the next.

Building an Empire: Radio Show and Business Ventures

From personal financial struggle to multimedia financial education empire, Dave Ramsey transformed his experiences into a platform that reaches millions of people worldwide.

Key business achievements:

- Launching “The Dave Ramsey Show” radio program

- Founding Ramsey Solutions (previously Financial Peace)

- Authoring multiple bestselling books

- Creating comprehensive online and in-person financial education programs

- Developing a network of certified financial coaches

His radio show became a lifeline for people struggling with financial challenges. Listeners found not just advice, but hope – real stories of people overcoming debt and building wealth.

Ramsey’s direct, no-nonsense communication style resonated with audiences tired of complex financial jargon.

Controversies and Criticisms

No influential public figure is without criticism, and Dave Ramsey has faced his share of challenges and controversial stances.

Major points of contention:

- Critique of his investment advice, particularly regarding mutual fund selections

- Debates about his company’s management style

- Religious undertones in financial advice

- Discussions around his seemingly one-size-fits-all approach to debt reduction

While critics argue that his advice might not be universally applicable, supporters maintain that his core principles of financial responsibility are sound.

Ramsey has consistently defended his methods, pointing to thousands of success stories from individuals who have transformed their financial lives.

Personal Life and Philanthropy

Beyond his financial teachings, Dave Ramsey is known for his commitment to family and charitable causes.

Personal and philanthropic highlights:

- Married to Sharon Ramsey for over 40 years

- Father to three children who are now involved in the family business

- Significant charitable contributions through his organization

- Emphasis on community giving and financial education

Ramsey’s personal life reflects the principles he teaches. His long-standing marriage and involvement of his children in his business demonstrate the practical application of financial and personal values.

Conclusion

Dave Ramsey has transcended the role of a financial advisor to become a movement leader who has inspired millions to take control of their financial destinies.

His story is a powerful reminder that financial setbacks are not permanent conditions but opportunities for transformation and growth.

From bankruptcy to building a multi-million dollar financial education empire, Ramsey’s journey exemplifies the principles he teaches: resilience, discipline, and the power of systematic financial planning.

Frequently Asked Questions (FAQ)

How did Dave Ramsey become a financial expert?

Dave Ramsey’s expertise emerged directly from personal experience, including his own financial bankruptcy and subsequent extensive research into personal finance management. His real-world struggles became the foundation of his financial philosophy.

What is the Debt Snowball Method?

The Debt Snowball Method involves paying off debts from smallest to largest, gaining psychological momentum with each debt eliminated. This approach focuses on the emotional win of clearing debts, which motivates continued financial discipline.

Is Dave Ramsey’s advice suitable for everyone?

While his principles are sound, individual financial situations vary. Financial experts recommend adapting his advice to personal circumstances and consulting with a financial advisor for personalized guidance.

How can I start following Dave Ramsey’s financial advice?

Begin by reading his books, listening to his podcast, and implementing the Seven Baby Steps. Start with creating an emergency fund and progressively work through each step, maintaining discipline and commitment.

What are Dave Ramsey’s views on investing?

Ramsey advocates for long-term, diversified investment strategies, primarily recommending mutual funds with consistent performance histories. He emphasizes understanding investments and avoiding high-risk speculation.

Has Dave Ramsey written any books?

Yes, he has authored several bestsellers, including “The Total Money Makeover” and “Financial Peace,” which detail his financial philosophy and provide practical guidance for achieving financial freedom.

How can I attend a Dave Ramsey financial course?

Courses are available through multiple platforms, including online courses via Ramsey Solutions, in-person workshops, and programs facilitated through local communities and churches.

The financial guru’s legacy continues to inspire and guide individuals toward financial independence, proving that with the right knowledge, discipline, and approach, anyone can transform their financial life.

![]()