As global economies navigate through uncertain waters in 2025, inflation remains a primary concern for investors worldwide. Investing in real assets has emerged as a powerful strategy to protect wealth and generate returns that outpace inflation.

These tangible investments, ranging from real estate to commodities, offer unique advantages that paper assets simply cannot match.

In this comprehensive guide, we’ll explore why investing in real assets is particularly crucial in 2025’s inflationary environment and how you can strategically position your portfolio to benefit from these investments.

Skale Money Key Takeaways

Before diving deep into the details, here are the essential points you need to know about investing in real assets:

- Real assets historically maintain or increase in value during inflationary periods

- They provide tangible value and generate reliable income streams

- Portfolio diversification benefits reduce overall investment risk

- Real assets offer tax advantages and appreciation potential

- Direct correlation with inflation makes them excellent hedges

Table of Contents

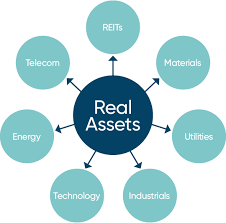

Understanding Real Assets and Inflation

Real assets are physical assets with intrinsic value, making them fundamentally different from financial assets like stocks and bonds. Their tangible nature provides a natural hedge against inflation, as their value typically increases with rising prices in the general economy.

Key Categories of Real Assets:

- Real Estate: Commercial properties, residential buildings, and REITs

- Commodities: Gold, silver, oil, and agricultural products

- Infrastructure: Toll roads, airports, and utilities

- Natural Resources: Timber, mining, and energy resources

- Precious Metals: Physical gold, silver, and platinum

Why Real Assets Outperform During Inflationary Periods

Real assets have consistently demonstrated superior performance during inflationary periods due to their inherent value proposition.

Unlike paper assets, real assets maintain their worth because they represent actual, physical items that fulfill fundamental economic needs.

Performance Comparison Table:

| Asset Type | Average Return During High Inflation | Inflation Protection Rating |

| Real Estate | 12.5% | ★★★★★ |

| Commodities | 15.8% | ★★★★ |

| Gold | 14.3% | ★★★★ |

| Bonds | 3.2% | ★★ |

| Cash | 1.5% | ★ |

Real Estate: The Crown Jewel of Real Asset Investing

Real estate stands out as one of the most accessible and understood forms of real asset investing.

Property values historically appreciate over time, while generating steady rental income – a powerful combination for inflation protection.

Investment Options:

- Residential Properties: Single-family homes and apartment buildings

- Commercial Real Estate: Office spaces and retail properties

- Industrial Properties: Warehouses and manufacturing facilities

- REITs: Professional managed real estate portfolios

- Real Estate Crowdfunding: Fractional ownership opportunities

Commodities and Natural Resources as Inflation Shields

Commodities provide excellent inflation protection because their prices typically rise with inflation. As basic inputs for the economy, their value is closely tied to overall economic activity and price levels.

Common Commodity Investments:

- Gold: Traditional safe-haven asset

- Agricultural Products: Food and fiber commodities

- Energy Resources: Oil, natural gas, and renewable energy

- Industrial Metals: Copper, aluminum, and steel

- Timber: Sustainable and growing demand

Infrastructure Investments: Stable Income During Uncertain Times

Infrastructure investments offer stability and predictable cash flows, making them particularly attractive during inflationary periods. These assets often have built-in inflation protection through contractual agreements.

Infrastructure Sectors:

- Transportation: Roads, railways, and ports

- Energy: Power generation and distribution

- Telecommunications: Cell towers and fiber networks

- Water: Treatment plants and distribution systems

- Social Infrastructure: Schools and hospitals

Strategic Asset Allocation for Inflation Protection

Proper asset allocation is crucial for maximizing the benefits of investing in real assets while managing risk effectively.

Sample Allocation Table:

| Real Asset Type | Conservative | Moderate | Aggressive |

| Real Estate | 15% | 25% | 35% |

| Commodities | 5% | 10% | 15% |

| Infrastructure | 10% | 15% | 20% |

| Traditional | 70% | 50% | 30% |

Investment Vehicles and Access Points

Modern investors have numerous options for gaining exposure to real assets, from direct ownership to more liquid investment vehicles.

Available Investment Options:

- Exchange-traded funds focused on real assets

- Specialty mutual funds

- Private REITs and investment trusts

- Direct ownership opportunities

- Digital investment platforms

Risk Management and Due Diligence

While real assets offer excellent inflation protection, they come with their own set of risks that must be carefully managed.

Key Risk Considerations:

- Liquidity Risk: Some real assets can be difficult to sell quickly

- Market Risk: Value fluctuations based on market conditions

- Management Risk: Quality of asset management

- Regulatory Risk: Changes in laws and regulations

- Environmental Risk: Natural disasters and climate change

Tax Implications and Considerations

Understanding the tax implications of real asset investments is crucial for maximizing after-tax returns.

Tax Planning Tips:

- Utilize 1031 exchanges for real estate

- Explore opportunity zone investments

- Implement cost segregation studies

- Consider tax-advantaged account structures

- Take advantage of depreciation benefits

Conclusion

Investing in real assets provides a tried-and-tested strategy for protecting wealth during inflationary periods. As we navigate through 2025’s economic landscape, the case for including real assets in your investment portfolio becomes increasingly compelling.

By carefully selecting and managing real asset investments, investors can build resilient portfolios that not only preserve wealth but potentially generate substantial returns above the inflation rate.

Frequently Asked Questions

What percentage of my portfolio should be in real assets?

Generally, financial advisors recommend allocating 15-35% of your portfolio to real assets, depending on your risk tolerance and investment goals.

How liquid are real asset investments?

Liquidity varies significantly among real assets. REITs and ETFs offer high liquidity, while direct property investments may take months to sell.

What’s the minimum investment required to start investing in real assets?

Through ETFs and crowdfunding platforms, you can start investing in real assets with as little as $500, though direct ownership typically requires more substantial capital.

Are real assets suitable for retirement accounts?

Yes, many real asset investments can be held in retirement accounts, though certain restrictions may apply depending on the specific investment type.

How do I choose between different types of real assets?

Consider your investment goals, risk tolerance, time horizon, and desired level of involvement in managing the investment.

What are the maintenance costs associated with real asset investments?

Maintenance costs vary by asset type. Physical properties require the most ongoing maintenance, while REITs and ETFs have minimal management fees.

How do real assets perform during economic recessions?

Real assets typically show lower correlation with traditional markets during recessions, potentially providing portfolio stability.

Can I invest in real assets through my existing brokerage account?

Many real asset investment vehicles, including REITs and ETFs, are available through standard brokerage accounts.

![]()