Imagine finding your dream home or the perfect car, only to hesitate because you’re worried that shopping for loans will destroy your credit score.

You’re not alone in this concern. Many people delay important financial decisions due to misconceptions about hard vs soft credit inquiries and their impact on credit scores. The good news?

You can shop for loans strategically without significantly impacting your creditworthiness. This comprehensive guide will walk you through everything you need to know about managing credit inquiries while seeking the best loan rates.

Skale Money Key Takeaways

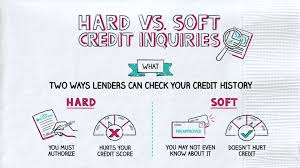

- Hard inquiries occur when lenders check your credit for loan applications and can temporarily impact your score

- Soft inquiries happen during background checks or pre-approvals and don’t affect your credit score

- Most scoring models allow 14-45 days for rate shopping without multiple penalties

- Strategic loan shopping and timing can minimize the impact on your credit score

Table of Contents

Understanding Credit Inquiries: The Basics

When it comes to hard vs soft credit inquiries, understanding the fundamental differences is crucial for managing your credit health. Each type serves a distinct purpose in the lending landscape and affects your credit profile differently.

- Hard Inquiries:

- Occur when you actively apply for new credit

- Require your explicit permission

- Show up on your credit report for potential lenders to see

- Can impact your credit score for up to 12 months

- Soft Inquiries:

- Happen during background checks or promotional offers

- Don’t require explicit permission

- Only visible to you on your credit report

- Have zero impact on your credit score

[Table: Common Scenarios for Credit Inquiries]

| Hard Inquiries | Soft Inquiries |

| Mortgage applications | Employment verification |

| Auto loan requests | Pre-qualified credit card offers |

| Credit card applications | Insurance quotes |

| Personal loan applications | Self-credit checks |

| Student loan applications | Account reviews by existing creditors |

The Real Impact on Your Credit Score

Understanding how hard vs soft credit inquiries affect your credit score is essential for making informed financial decisions. While the impact of hard inquiries is often overestimated, it’s still important to manage them wisely.

- Hard Inquiry Impact:

- Typically reduces your score by 5-10 points

- Effect diminishes over time

- Multiple inquiries for the same type of loan within a short period count as one

- Remains on your credit report for 24 months

- Soft Inquiry Impact:

- No effect on credit score

- Unlimited number of soft inquiries possible

- Provides valuable information without penalties

- Helps with financial planning

[Table: Credit Score Impact]

| Action | Points Impact | Duration |

| Single hard inquiry | 5-10 points | 12 months |

| Multiple inquiries | Varies | 24 months |

| Soft inquiries | 0 points | N/A |

Rate Shopping Windows: Making the Most of Your Time

Smart rate shopping requires understanding how credit scoring models treat multiple hard vs soft credit inquiries within specific timeframes. This knowledge can help you maximize your chances of finding the best rates while minimizing credit score impact.

- Rate Shopping Periods:

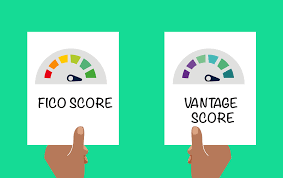

- FICO Score gives 14-45 days for rate shopping

- VantageScore allows 14 days for multiple inquiries

- Mortgage, auto, and student loan inquiries typically bundled

- Credit card applications always count separately

- Best Practices for Timing:

- Gather all documents before starting applications

- Complete all applications within two weeks

- Avoid mixing different types of credit applications

- Monitor your credit report during the process

Smart Strategies for Loan Shopping

Developing a strategic approach to loan shopping helps you navigate hard vs soft credit inquiries effectively while securing the best possible rates.

- Before You Shop:

- Review your credit report for accuracy

- Check your current credit score

- Prepare required documentation

- Research potential lenders and their requirements

- During Shopping:

- Use pre-qualification tools when available

- Keep track of all applications and inquiries

- Compare rates and terms systematically

- Document all communications with lenders

- After Applications:

- Monitor your credit report for new inquiries

- Save all approval letters and offers

- Track response deadlines

- Follow up on any unauthorized inquiries

Understanding Your Rights Under the Law

When it comes to hard vs soft credit inquiries, federal law provides important consumer protections that you should understand and be ready to exercise.

- Legal Rights:

- Free annual credit reports from each bureau

- Explanation requirement for loan denials

- Right to dispute incorrect information

- Access to credit score information

- Consumer Protections:

- 60 days to dispute unauthorized inquiries

- Right to fraud alerts and credit freezes

- Protection from discriminatory practices

- Access to adverse action notices

Digital Tools and Resources for Credit Monitoring

Modern technology provides numerous tools to help you track both hard vs soft credit inquiries and maintain your credit health.

[Table: Credit Monitoring Services]

| Service Type | Features | Cost Range |

| Basic | Score monitoring | $0-10/month |

| Premium | Real-time alerts | $15-25/month |

| Comprehensive | Identity protection | $25+/month |

- Free Monitoring Tools:

- Credit Karma

- Annual Credit Report website

- Bank and credit card monitoring services

- Credit freeze portals

Industry-Specific Shopping Tips

Different loan types require different approaches when managing hard vs soft credit inquiries.

- Mortgage Shopping:

- Get pre-qualified before house hunting

- Complete all applications within 14 days

- Maintain stable employment during process

- Avoid new credit applications

- Auto Loans:

- Research rates before visiting dealers

- Get pre-approved through your bank

- Compare dealer financing options

- Complete applications within shopping window

- Personal Loans:

- Use pre-qualification tools

- Compare online lenders

- Consider credit union membership

- Watch for promotional rates

Maintaining Good Credit Beyond Inquiries

While managing hard vs soft credit inquiries is important, overall credit health depends on multiple factors.

- Best Practices:

- Pay all bills on time

- Keep credit utilization below 30%

- Maintain a mix of credit types

- Monitor credit reports regularly

- Long-term Strategies:

- Build emergency savings

- Plan major purchases in advance

- Maintain older credit accounts

- Review credit reports quarterly

Conclusion

Understanding the difference between hard vs soft credit inquiries empowers you to shop for loans confidently while protecting your credit score.

By following the strategies outlined in this guide, you can navigate the loan shopping process effectively, find the best rates, and maintain your credit health.

Remember, smart rate shopping within designated windows won’t significantly impact your credit score, so don’t let inquiry fears prevent you from seeking the best financial products for your needs.

Frequently Asked Questions (FAQ)

How many points will a hard inquiry drop my credit score?

Typically, a hard inquiry will lower your score by 5-10 points and the impact diminishes over time.

How long do hard inquiries stay on my credit report?

Hard inquiries remain on your credit report for 24 months but only affect your score for 12 months.

Can I remove hard inquiries from my credit report?

You can only remove incorrect or unauthorized hard inquiries through the dispute process with credit bureaus.

Do soft inquiries ever become hard inquiries?

No, soft inquiries remain soft. However, if you proceed with a full application after pre-qualification, that will result in a new hard inquiry.

How many loan applications can I submit in 14 days?

You can submit multiple applications for the same type of loan within 14 days, and they’ll typically count as one inquiry for scoring purposes.

Will shopping for different types of loans hurt my credit more?

Yes, applications for different types of credit (like a car loan and a credit card) will count as separate hard inquiries.

Can employers see my hard inquiries?

No, employers conducting credit checks only see modified reports without hard inquiry information.

How can I dispute unauthorized hard inquiries?

Contact the credit bureaus directly through their online dispute processes or by mail, providing documentation of the unauthorized inquiry.

![]()