As Sarah walked out of her third bank meeting with yet another loan rejection, she realized that her dream of expanding her successful local bakery into a regional chain wasn’t being held back by her business plan or market conditions – it was her credit score.

Like many entrepreneurs, Sarah had learned the hard way about the critical importance of credit scores in the business world. For entrepreneurs and small business owners, understanding the importance of credit scores isn’t just about securing loans – it’s about laying the foundation for sustainable business growth.

Your credit score can be the difference between seizing a golden opportunity and watching it slip away. In this comprehensive guide, we’ll explore how credit scores impact every aspect of your business journey and provide actionable strategies for building and maintaining strong credit.

According to the Small Business Administration, about 27% of businesses are denied credit due to poor credit scores, and those who do receive funding often face interest rates up to 150% higher than their better-credited counterparts. These statistics underscore the critical importance of credit scores in the entrepreneurial landscape.

Skale Money Key Takeaways

Before diving deep into the details, here are the essential points about the importance of credit scores for your business success:

- Credit scores affect every aspect of your business, from startup funding to operational costs

- Both personal and business credit scores play crucial roles in your company’s financial health

- Strong credit scores can save thousands in interest payments and unlock premium financing options

- Building business credit early can reduce personal financial liability

- Regular monitoring and strategic credit management are essential for long-term success

Table of Contents

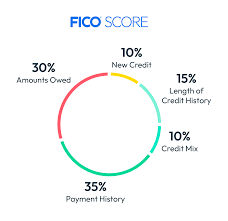

Understanding Personal vs. Business Credit Scores

Your journey as an entrepreneur involves navigating both personal and business credit landscapes. Understanding the distinction between these two types of scores is crucial for effective financial management.

Personal and business credit scores serve different purposes and are calculated differently:

- Personal Credit Scores:

- Range from 300-850

- Reported by TransUnion, Equifax, and Experian

- Based on personal financial history

- Influenced by credit card payments, mortgages, and personal loans

- Business Credit Scores:

- Range from 0-100

- Reported by Dun & Bradstreet, Equifax Business, and Experian Business

- Based on business payment history and financial health

- Influenced by vendor payments, business loans, and company credit cards

Table: Credit Score Comparison

| Aspect | Personal Credit | Business Credit |

| Score Range | 300-850 | 0-100 |

| Primary Use | Personal Finance | Business Operations |

| Reporting Agencies | TransUnion, Equifax, Experian | D&B, Equifax Business, Experian Business |

| Privacy | Protected by Law | Publicly Available |

| Impact Duration | 7-10 years | 3-7 years |

How Personal Credit Scores Impact Your Startup Journey

When launching a business, your personal credit score often serves as the gateway to initial funding and opportunities. The importance of credit scores becomes particularly evident during the startup phase.

Your personal credit score influences:

- Loan approval probability and terms

- Credit card limits and rewards programs

- Equipment lease rates

- Initial supplier relationships

- Commercial real estate leases

Consider this: A business owner with a credit score of 750+ might secure a $100,000 business loan at 6% APR, while someone with a score of 650 might face rates of 15% or higher – resulting in over $45,000 in additional interest over a five-year term.

Building Business Credit: From Personal to Professional

Transitioning from personal to business credit requires careful planning and consistent execution. This process typically takes 2-3 years for full establishment.

Essential steps for building business credit:

- Legal Foundation:

- Register your business entity (LLC, Corporation)

- Obtain an EIN from the IRS

- Open a business bank account

- Establish a business phone line

- Initial Credit Building:

- Apply for a business credit card

- Open vendor credit accounts

- Maintain timely payments

- Monitor credit reports regularly

Timeline Table: Business Credit Building Milestones

| Month | Action | Goal |

| 1-3 | Entity Setup & Documentation | Establish Legal Foundation |

| 4-6 | Initial Vendor Accounts | Build Payment History |

| 7-12 | Credit Card Applications | Expand Credit Mix |

| 13-24 | Loan Applications | Increase Credit Capacity |

Financing Options Based on Credit Score Ranges

Understanding available financing options based on your credit score helps set realistic expectations and goals.

Excellent (750+):

- Traditional bank loans with prime rates

- SBA loans with minimal down payments

- Premium business credit cards

- Line of credit options with flexible terms

Good (700-749):

- Bank loans with competitive rates

- Equipment financing

- Business expansion loans

- Merchant cash advances

Fair (650-699):

- Online lender options

- Higher-interest term loans

- Secured credit cards

- Invoice factoring

Poor (Below 650):

- Secured loans

- Alternative lending options

- Asset-based lending

- Microloans

Credit Score Impact on Business Operations

The importance of credit scores extends far beyond lending. Your score influences daily operations and growth opportunities.

Operational aspects affected:

- Supplier payment terms and discounts

- Insurance premium rates

- Equipment lease terms

- Government and corporate contract eligibility

- Employee benefit program costs

Real-world impact: A construction company with excellent credit might secure 60-day payment terms with suppliers, while a similar company with poor credit might need to pay upfront, affecting cash flow and project bidding capabilities.

Strategic Credit Management for Business Growth

Maintaining and improving your credit score requires ongoing attention and strategic management.

Key strategies for credit management:

- Monitor credit reports monthly

- Keep credit utilization below 30%

- Maintain diverse credit mix

- Address disputes promptly

- Separate personal and business expenses

Action steps for improvement:

- Set up automatic payments

- Review credit reports quarterly

- Maintain detailed payment records

- Build emergency funds

- Establish vendor credit references

Credit Score Recovery: Overcoming Business Setbacks

Even successful businesses may face credit challenges. The key is having a solid recovery plan.

Recovery strategies include:

- Debt consolidation options

- Credit counseling services

- Alternative financing arrangements

- Professional credit repair services

Timeline for improvement:

- 3-6 months: Address immediate issues

- 6-12 months: Establish positive payment history

- 12-24 months: Rebuild credit score

- 24+ months: Maintain and optimize credit

Future-Proofing Your Business Credit

Protecting your credit score requires proactive management and risk mitigation.

Preventive measures:

- Regular credit monitoring services

- Fraud protection systems

- Emergency fund maintenance

- Insurance coverage review

- Professional financial advice

Conclusion

The importance of credit scores for entrepreneurs and small business owners cannot be overstated. From securing initial funding to managing daily operations and planning for growth, your credit score influences every aspect of your business journey.

By understanding the relationship between personal and business credit, implementing strategic credit management practices, and maintaining a proactive approach to credit health, you can build a strong foundation for business success.

Remember Sarah from our introduction? Six months after her loan rejection, she implemented the strategies outlined in this guide. Within 18 months, her credit score improved by 85 points, helping her secure the funding needed to open her second location. Today, she operates five successful bakeries and maintains excellent business credit.

FAQ Section

How quickly can I build business credit?

Building strong business credit typically takes 2-3 years of consistent positive payment history and strategic credit management.

Can I get business loans with bad personal credit?

Yes, but options may be limited and interest rates will likely be higher. Alternative lenders and secured loans might be available.

Should I separate personal and business credit completely?

Yes, separating personal and business credit protects personal assets and helps establish a strong business credit profile.

How often should I check my business credit score?

Monitor your business credit score monthly to catch issues early and maintain accurate reporting.

What’s the minimum credit score needed for business loans?

Traditional banks typically require scores of 680+ for business loans, while alternative lenders may accept scores as low as 600.

Can business credit affect personal credit scores?

Generally no, but if you personally guarantee business debt, late payments could impact your personal credit.

Additional Resources

- SCORE.org – Free business mentoring and education

- SBA.gov – Government resources for small businesses

- Nav.com – Business credit monitoring and management

- National Foundation for Credit Counseling – Credit education and counseling services

By understanding and actively managing your credit scores, you position your business for sustainable growth and success. Remember, good credit is not just about access to capital – it’s about creating opportunities and building a stronger, more resilient business.

![]()