Imagine if you could distill your entire financial history into a single, powerful number. That’s exactly what a credit score does – it’s like a financial DNA test that reveals the intricate details of your monetary behavior.

Understanding how is credit score calculated isn’t just about deciphering a mysterious algorithm; it’s about gaining insight into your financial health and potential.

Your credit score is more than just digits on a screen. It’s a powerful indicator that can open doors to opportunities or create barriers to your financial dreams. From securing a mortgage to landing a dream job, this three-digit number speaks volumes about your financial responsibility.

In this comprehensive guide, we’ll unravel the complex world of credit scoring, helping you understand every nuance of how is credit score calculated.

What Exactly is a Credit Score?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850.

This sophisticated scoring system evaluates your financial reliability based on your credit history, providing lenders, landlords, and even some employers a quick snapshot of your financial health.

Key points about credit scores include:

- A standardized method of assessing financial risk

- Created to provide an objective measure of credit reliability

- Used by financial institutions to make lending decisions

- Reflects your past financial behavior and potential future reliability

| Score Range | Rating | Typical Implications |

| 800-850 | Exceptional | Best rates, highest approval odds |

| 740-799 | Very Good | Favorable terms |

| 670-739 | Good | Standard rates |

| 580-669 | Fair | Higher interest rates |

| 300-579 | Poor | Difficult credit access |

The Credit Score Architects: Meet the Credit Bureaus

Behind every credit score are three major credit bureaus: Equifax, Experian, and TransUnion. These financial data powerhouses collect, compile, and maintain your credit information, creating the foundation for how is credit score calculated.

Key insights about credit bureaus:

- Independent organizations that track financial histories

- Collect information from banks, credit card companies, and other financial institutions

- Generate credit reports used to calculate credit scores

- Each bureau may have slightly different information

- Responsible for maintaining accurate financial records

The FICO Score: Breaking Down the Financial Blueprint

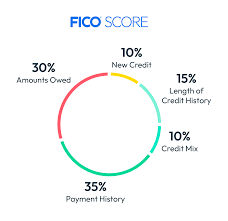

When most people ask how is credit score calculated, they’re typically referring to the FICO score – the most widely used credit scoring model. Developed by the Fair Isaac Corporation, this model breaks down your financial behavior into five key components.

Score Composition:

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- Credit Mix (10%)

- New Credit Inquiries (10%)

Deep Dive: Payment History – The Most Critical Factor

Your payment history is the heavyweight champion of credit scoring, accounting for 35% of your total score. This factor examines your track record of paying bills on time, including credit cards, loans, and other financial obligations.

Advice for maintaining a strong payment history:

- Set up automatic payments

- Create digital or physical payment reminders

- Establish emergency funds to cover unexpected expenses

- Negotiate with creditors if you’re experiencing financial difficulties

- Never miss a payment by more than 30 days

Credit Utilization: The Balancing Act

Credit utilization measures how much of your available credit you’re using. It’s the second most important factor in how is credit score calculated, representing 30% of your total score.

Strategic utilization tips:

- Keep credit card balances below 30% of your total credit limit

- Pay down existing balances

- Consider requesting credit limit increases

- Use multiple credit cards to spread out utilization

- Monitor your credit utilization monthly

Length of Credit History: Time Matters

This factor considers the age of your oldest and newest credit accounts, along with the average age of all accounts. It demonstrates your long-term financial stability and responsibility.

Strategies for building credit history:

- Keep old credit accounts open

- Avoid closing long-standing credit lines

- Be patient and build credit slowly

- Maintain a mix of credit types

- Avoid opening too many new accounts quickly

Credit Mix: Diversity is Strength

A diverse credit portfolio shows lenders you can manage different types of credit responsibly. This factor contributes 10% to your overall score.

Recommended credit mix:

- Revolving credit (credit cards)

- Installment loans (mortgage, auto loans)

- Personal loans

- Student loans

- Retail credit accounts

New Credit Inquiries: Proceed with Caution

Each time you apply for credit, a hard inquiry is placed on your report. While necessary, too many inquiries can negatively impact how is credit score calculated.

Best practices:

- Limit credit applications

- Understand the difference between hard and soft inquiries

- Group similar loan applications within a short time frame

- Be strategic about when and why you apply for new credit

Red Flags and Credit Score Killers

Common mistakes that can devastate your credit score:

- Consistently late or missed payments

- Maxing out credit cards

- Frequently applying for new credit

- Closing old credit accounts

- Ignoring credit report errors

- Defaulting on loans

Improving Your Credit Score: A Step-by-Step Guide

Comprehensive strategy for score improvement:

- Obtain and review your credit reports annually

- Dispute any errors you find

- Pay all bills on time

- Reduce existing debt

- Keep credit utilization low

- Avoid unnecessary credit applications

- Consider a secured credit card if rebuilding credit

Emerging Trends in Credit Scoring

The future of credit scoring is evolving:

- Artificial intelligence integration

- Alternative data source consideration

- More inclusive scoring models

- Real-time credit assessment

- Personalized credit evaluation

Skale Money Key Takeaways: Your Financial Health Snapshot

- Credit scores are complex but manageable

- Every financial decision impacts your score

- Consistency is key to maintaining good credit

- Understanding how is credit score calculated empowers you

- Regular monitoring prevents unexpected issues

Conclusion: Your Credit Score, Your Financial Passport

Your credit score is more than a number – it’s a powerful tool that can open doors or create barriers. By understanding how is credit score calculated, you take the first step toward financial empowerment. Remember, your financial journey is ongoing, and your credit score is a reflection of your progress.

Frequently Asked Questions (FAQ)

How often should I check my credit score?

At least once a year, or before major financial decisions. Many credit card companies now offer free monthly credit score updates.

Does checking my credit score hurt my credit?

No, checking your own credit score is a soft inquiry and does not impact your credit.

How long do negative items stay on my credit report?

Most negative items remain for 7 years, with some bankruptcies lasting up to 10 years.

Can I improve my credit score quickly?

Significant improvements take time, but you can see gradual improvements by consistently practicing good credit habits.

What’s the difference between a credit score and a credit report?

A credit report is a detailed record of your credit history, while a credit score is a numerical representation derived from that report.

Additional Resources

- Free credit report websites

- Credit counseling services

- Financial education platforms

- Credit monitoring tools

Disclaimer: This guide provides general information about how credit scores are calculated. Individual circumstances may vary, and it’s always recommended to consult with a financial advisor for personalized guidance.

![]()