Your financial behavior is more than just a series of decisions – it’s a complex web of psychological patterns that directly influence your interest rates and credit scores. Understanding this relationship can be the key to unlocking better financial outcomes and making more informed decisions about your money.

The connection between our minds and our money runs deeper than most people realize. Every financial decision you make, from paying bills to applying for loans, is influenced by psychological factors that shape both your interest rates and credit scores.

This intricate relationship affects not just your current financial situation but your long-term financial well-being. Throughout this article, we’ll explore how your thought patterns, emotions, and behaviors create a powerful impact on your financial outcomes.

Skale Money Key Takeaways

Before diving deep into the psychology behind interest rates and credit scores, here are the essential points you’ll learn:

- Your psychological patterns directly influence financial behaviors that impact both interest rates and credit scores

- Understanding risk perception can help you make better financial decisions

- Delayed gratification plays a crucial role in building positive credit history

- Social influences significantly affect your credit-related choices

- Stress management is vital for maintaining good credit habits

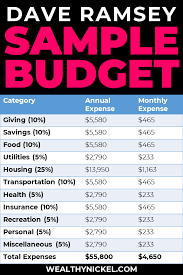

| Behavior Pattern | Impact on Credit Score | Effect on Interest Rates |

| Regular payments | Strong positive impact | Lower rates offered |

| Impulsive spending | Moderate negative impact | Higher risk assessment |

| Consistent saving | Indirect positive impact | Better loan terms |

| Avoiding credit | Neutral to negative impact | Limited rate options |

Table of Contents

Understanding the Basics: The Interconnection Between Psychology and Finance

The field of behavioral economics has revealed that our financial decisions are rarely purely rational. Instead, they’re heavily influenced by psychological factors that can either help or hinder our financial success.

When it comes to interest rates and credit scores, understanding these psychological influences becomes crucial for making better financial choices.

Key psychological factors affecting financial decisions:

- Loss aversion: The tendency to prefer avoiding losses over acquiring equivalent gains

- Present bias: Favoring immediate rewards over long-term benefits

- Decision paralysis: Becoming overwhelmed by too many financial choices

- Risk perception: How we evaluate and respond to financial risks and opportunities

| Psychological Factor | Financial Impact | Credit Score Effect |

| Loss Aversion | Conservative borrowing | Slower credit building |

| Present Bias | Impulse purchases | Higher utilization |

| Decision Paralysis | Missed opportunities | Stagnant score |

| Risk Perception | Borrowing patterns | Credit mix impact |

The Risk Perception Paradox: How Your Brain Evaluates Financial Decisions

Understanding how we perceive and evaluate financial risk is crucial when examining the relationship between interest rates and credit scores.

Our brains often use emotional shortcuts rather than logical analysis when making financial decisions, which can lead to suboptimal choices in managing credit and evaluating loan terms.

Key aspects of risk perception:

- Emotional decision-making often overrides rational analysis in financial choices

- Past experiences shape how we view financial risks and opportunities

- Social influences can distort our perception of financial risk

- Media and marketing messages affect our risk assessment

Instant Gratification vs. Long-term Benefits: The Time Value Battle

The struggle between immediate rewards and long-term financial health is at the heart of many credit-related decisions. Understanding how interest rates and credit scores are affected by our ability to delay gratification can help us make better choices for our financial future.

Psychological challenges in delayed gratification:

- Immediate reward temptation versus long-term credit benefits

- The impact of marketing on spending impulses

- How stress affects our ability to wait for better financial outcomes

- Strategies for strengthening financial willpower

The Self-Fulfilling Prophecy: How Your Money Mindset Affects Credit Outcomes

Your beliefs about money and credit often create self-fulfilling prophecies that impact both your interest rates and credit scores. A positive money mindset can lead to better financial behaviors, while negative beliefs can create destructive patterns.

Key mindset patterns:

- Scarcity thinking often leads to panic borrowing

- Abundance mindset promotes strategic credit use

- Self-efficacy beliefs influence financial confidence

- Growth mindset enables credit score improvement

The Social Psychology of Credit: How Peer Influence Shapes Financial Behavior

Our financial decisions, including those affecting interest rates and credit scores, are significantly influenced by our social environment. Understanding these influences can help us make more independent and beneficial financial choices.

Social factors affecting credit behavior:

- Peer pressure can lead to overspending

- Social comparison affects financial satisfaction

- Cultural beliefs shape credit usage patterns

- Family attitudes influence financial habits

Stress, Anxiety, and Financial Decision-Making

Financial stress can create a vicious cycle that affects both interest rates and credit scores. Understanding how stress impacts our financial decisions is crucial for maintaining healthy credit habits.

Key stress factors:

- Financial anxiety can lead to avoidance behaviors

- Stress affects decision-making quality

- Emotional spending as a coping mechanism

- Impact of financial worry on credit management

Building Positive Financial Habits: The Psychology of Credit Score Improvement

Creating sustainable financial habits is essential for maintaining good credit scores and securing favorable interest rates. Understanding the psychology of habit formation can help you build positive financial patterns.

Framework for habit building:

- Identify current financial triggers

- Establish new positive routines

- Create reward systems for good habits

- Track progress and adjust strategies

The Technology Factor: How Digital Tools Impact Financial Psychology

Modern technology has transformed how we interact with our finances, creating both opportunities and challenges for managing interest rates and credit scores.

Digital influences:

- Mobile banking affects spending patterns

- Automated payments improve credit scores

- Digital tools provide immediate feedback

- Technology can enable better financial choices

Creating Your Financial Psychology Action Plan

Implementing what you’ve learned about the psychology of interest rates and credit scores requires a structured approach. Here’s how to create your personal action plan:

Step-by-step guide:

- Assess your current financial mindset

- Identify psychological barriers

- Set specific, measurable goals

- Create accountability systems

- Monitor and adjust your plan

Conclusion

Understanding the psychology behind interest rates and credit scores is crucial for improving your financial health.

By recognizing how your thoughts, emotions, and behaviors influence your financial decisions, you can make better choices that lead to improved credit scores and more favorable interest rates. Remember that changing financial behaviors takes time and patience, but the long-term benefits are worth the effort.

FAQ Section

How quickly can psychological changes affect credit scores?

While psychological changes can lead to immediate behavior improvements, credit score changes typically take 3-6 months to reflect new patterns.

Can financial therapy help improve credit scores?

Yes, financial therapy can help address underlying psychological barriers that may be preventing you from maintaining good credit habits.

What role does personality type play in interest rates and credit scores?

Personality traits like conscientiousness and risk tolerance can significantly influence financial behaviors that affect both interest rates and credit scores.

How can I overcome ingrained negative financial behaviors?

Start by identifying triggers, creating new positive habits, and seeking support from financial professionals or counselors.

What are the most common psychological barriers to good credit?

Common barriers include fear of financial institutions, anxiety about debt, and difficulty with delayed gratification.

How do different cultures approach credit and interest differently?

Cultural attitudes toward debt, saving, and financial risk can vary significantly, influencing how individuals manage their credit and approach interest rates.

By understanding and actively managing the psychological factors that influence your financial behavior, you can work toward better interest rates and credit scores. Remember that small, consistent changes in your financial habits can lead to significant improvements in your credit profile over time.