In today’s interconnected global economy, understanding the factors affecting credit scores has become increasingly important, not just for Americans but for people worldwide.

As international business and travel become more common, knowing how credit systems work across different countries can provide valuable insights into managing and improving one’s financial standing.

The factors affecting credit scores vary significantly from country to country, reflecting different cultural attitudes, regulatory frameworks, and financial systems.

This comprehensive guide explores these variations and extracts valuable lessons that Americans can apply to enhance their credit profiles.

Skale Money Key Takeaways

Before diving deep into the global credit landscape, here are the essential points you’ll learn about factors affecting credit scores across different countries:

- Credit scoring systems vary significantly by country, with some nations using numerical ranges similar to the US (300-850) while others employ entirely different scales or alternative assessment methods

- Cultural attitudes toward credit and debt significantly influence how credit scores are calculated and interpreted in different regions

- Many countries are incorporating alternative data sources and technological innovations into their credit assessment processes

- Understanding global credit practices can help Americans adopt more comprehensive credit-building strategies

- Emerging markets are revolutionizing credit assessment through digital innovation and financial inclusion initiatives

Table of Contents

Understanding the American Credit System (Baseline Comparison)

The American credit system serves as a useful baseline for understanding how factors affecting credit scores differ globally.

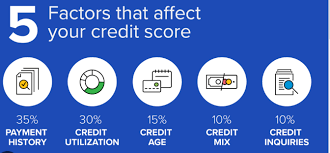

In the United States, credit scores typically range from 300 to 850, with scores calculated by three major credit bureaus: Experian, TransUnion, and Equifax. The FICO scoring model considers several key factors:

- Payment history (35% of score)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit applications (10%)

This standardized approach, while comprehensive, differs markedly from systems used in other countries.

The United Kingdom’s Credit Assessment Approach

The UK’s credit scoring system shares some similarities with the US model but incorporates unique elements that reflect British financial culture and regulations.

Unlike the standardized American system, UK credit scores vary by bureau, with Experian using a 0-999 range and Equifax operating on a 0-700 scale.

The factors affecting credit scores in the UK include:

- Electoral roll registration status

- Current account management

- Previous address history

- Banking relationship longevity

- Payment history on credit accounts

The UK system places particular emphasis on electoral roll registration, which serves as a verification of residence and identity. This unique factor demonstrates how local administrative systems can influence credit assessment methods.

Canada’s Credit Scoring Innovations

Canada’s approach to credit scoring represents a hybrid model that combines elements of the American system with distinctive Canadian features. While using a similar 300-850 range, Canadian credit scores are influenced by several unique factors:

- Telephone and utility payment history

- Rent payment records

- Provincial variations in credit reporting

- Emphasis on banking relationship stability

Canadian lenders often take a more conservative approach to credit assessment, with a stronger focus on long-term financial stability rather than short-term credit utilization.

The German Alternative: Schufa Scoring

Germany’s SCHUFA system offers a markedly different approach to credit assessment, reflecting the country’s conservative attitude toward debt and strong emphasis on privacy protection.

The factors affecting credit scores in Germany include:

- Bank account management history

- Prompt payment of bills and obligations

- Number of credit accounts

- Length of residence at current address

- Employment stability

Notable aspects of the German system:

- Strong privacy protections for consumer data

- Limited use of credit cards compared to other developed nations

- Emphasis on cash transactions and direct debits

- Focus on long-term financial stability

Asian Credit Systems: China and Japan

The Asian approach to credit assessment reflects distinct cultural and economic factors, with China and Japan offering contrasting examples of how factors affecting credit scores can vary within the same region.

China’s Social Credit System:

- Combines traditional financial metrics with social behavior

- Incorporates technology and big data analytics

- Considers social and civic responsibility

- Evaluates online shopping and payment behaviors

Japan’s Credit Assessment:

- Limited credit card usage and credit culture

- Strong emphasis on relationship banking

- Alternative assessment methods including employment stability

- Consideration of family ties and social standing

Australia’s Credit Scoring Framework

Australia’s Comprehensive Credit Reporting (CCR) system represents a modern approach to credit assessment that balances consumer protection with lender information needs. Key aspects include:

- Positive and negative credit reporting

- Strong privacy regulations

- Emphasis on regular income and savings history

- Consideration of rental payment history

Australian factors affecting credit scores:

- Payment history on loans and credit cards

- Credit utilization rates

- Length of credit history

- Types of credit held

- Recent credit applications

Emerging Markets: India and Brazil

Emerging markets are revolutionizing credit assessment through innovative approaches that address unique local challenges:

India’s System:

- Digital payment history integration

- Mobile phone usage patterns

- Social media data analysis

- Alternative data sources for the unbanked

Brazil’s Approach:

- Simplified scoring systems

- Focus on financial inclusion

- Integration of microfinance history

- Consideration of informal income sources

Universal Best Practices from Global Systems

Analysis of global credit systems reveals several universal best practices that transcend national boundaries:

- Regular monitoring of credit reports

- Maintaining low credit utilization

- Building long-term banking relationships

- Demonstrating stable residence and employment

- Careful management of payment obligations

These practices contribute positively to credit scores regardless of location:

- Timely bill payment

- Responsible credit use

- Long-term financial planning

- Regular credit report review

- Prompt error correction

Future of Global Credit Scoring

The future of credit scoring is being shaped by several emerging trends:

- Artificial intelligence and machine learning implementation

- Alternative data source integration

- Cross-border credit reporting systems

- Blockchain technology adoption

- Behavioral scoring models

These developments suggest a move toward:

- More nuanced credit assessment

- Greater financial inclusion

- Improved accuracy in risk assessment

- Enhanced global credit mobility

Practical Tips for Americans

Americans can benefit from global credit practices by:

- Maintaining comprehensive financial records

- Building relationships with financial institutions

- Considering alternative credit-building methods

- Developing a global credit presence when possible

- Understanding international credit reporting systems

Action steps for improving credit globally:

- Register on electoral rolls when living abroad

- Maintain international banking relationships

- Document all sources of income

- Keep detailed payment records

- Build credit history in multiple countries when possible

Conclusion

Understanding how factors affecting credit scores vary across different countries provides valuable insights for Americans seeking to optimize their credit profiles.

While each country’s system reflects its unique cultural, economic, and regulatory environment, certain universal principles emerge: the importance of consistent payment history, responsible credit use, and long-term financial stability.

As credit scoring systems continue to evolve and incorporate new technologies and data sources, maintaining awareness of global best practices becomes increasingly valuable for building and maintaining strong credit profiles.

FAQ Section

How do credit scores differ between countries?

Credit scores vary significantly between countries in terms of scoring ranges, calculation methods, and factors considered. While the US uses a 300-850 range, other countries may use different scales or alternative assessment methods.

Can my US credit score be used internationally?

Generally, credit scores don’t transfer directly between countries. Each nation maintains its own credit reporting system, requiring individuals to build credit history separately in each country.

Which country has the most stringent credit scoring system?

Germany is often considered to have one of the most stringent systems, with strict privacy protection and conservative lending practices. However, China’s social credit system introduces unique monitoring elements.

How can I build credit in multiple countries?

Building international credit requires establishing banking relationships in each country, maintaining local accounts, and following country-specific credit-building practices.

What global factors affect credit scores universally?

Payment history, credit utilization, length of credit history, and stable employment/residence are factors that generally affect credit scores across most countries.

How are emerging markets changing credit scoring?

Emerging markets are innovating through digital payment systems, alternative data sources, and simplified scoring models to increase financial inclusion and accommodate local economic conditions.

This comprehensive exploration of factors affecting credit scores across different countries demonstrates the complexity and diversity of global credit assessment systems while providing valuable insights for Americans seeking to understand and improve their credit profiles in an increasingly interconnected world.

![]()