Imagine having a secret financial passport that determines your access to dreams—buying a home, starting a business, or securing that dream car. This passport isn’t a document you can hold, but a three-digit number that wields incredible power: your credit score.

Whether you’re struggling with a low score or aiming to reach financial excellence, this comprehensive guide will unveil 15 surprising strategies for how to improve credit score rapidly and effectively.

Your credit score is more than just a number—it’s a reflection of your financial health, a numerical representation of your trustworthiness in the eyes of lenders.

In this transformative journey, we’ll break down complex financial strategies into actionable, easy-to-implement steps that can help you take control of your financial future.

Table of Contents

What is a Credit Score and Why Does It Matter?

Understanding Credit Score Basics

Your credit score is a powerful financial indicator that can make or break your economic opportunities.

This numerical rating, typically ranging from 300 to 850, serves as a snapshot of your creditworthiness, telling lenders how likely you are to repay borrowed money.

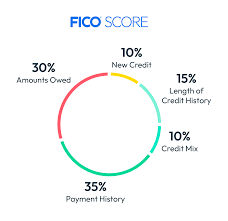

Key points about credit scores include:

- Calculated based on your credit history

- Considers factors like payment history, credit utilization, and credit mix

- Used by lenders, landlords, and sometimes even employers

- Directly impacts your ability to secure loans, credit cards, and favorable interest rates

Credit Score Breakdown Table

| Score Range | Rating | Impact |

| 300-579 | Poor | Extremely difficult to obtain credit |

| 580-669 | Fair | Limited credit options |

| 670-739 | Good | Moderate credit accessibility |

| 740-799 | Very Good | Favorable terms and rates |

| 800-850 | Exceptional | Best rates and highest approval |

Strategy 1: The Credit Card Utilization Hack

Credit card utilization is a critical factor in how to improve credit score, yet many people overlook its importance. This strategy focuses on managing the percentage of your available credit that you’re currently using.

Key strategies for credit card utilization:

- Maintain a credit utilization ratio below 30%

- Make multiple payments throughout the month

- Request credit limit increases

- Time your credit card payments strategically

- Use credit monitoring tools to track utilization

Strategy 2: Become an Authorized User (The Stealth Boost)

One of the most clever ways to improve credit score is by becoming an authorized user on someone else’s credit card. This method can rapidly boost your credit profile with minimal effort.

Authorized user strategy tips:

- Choose a primary cardholder with excellent credit history

- Ensure the credit card issuer reports authorized users to credit bureaus

- Communicate clearly with the primary cardholder

- Understand potential risks and benefits

- Monitor your credit report for positive impacts

Strategy 3: Dispute Errors Like a Pro

Credit report errors can significantly drag down your credit score. Learning how to identify and dispute these errors is crucial in your credit score improvement journey.

Error dispute process:

- Obtain free credit reports from all three major bureaus

- Carefully review each report for inaccuracies

- Gather documentation to support your disputes

- File disputes with credit bureaus online or by mail

- Follow up and verify corrections

Credit Report Error Tracking Table

| Error Type | Action | Potential Impact |

| Incorrect Personal Info | Dispute Immediately | Prevents Identity Issues |

| Duplicate Accounts | Remove Duplicates | Reduces Apparent Debt |

| Incorrect Account Status | Update Status | Improves Credit Calculation |

| Fraudulent Accounts | Investigate & Remove | Protects Credit Score |

Strategy 4: The Secured Credit Card Transformation

Secured credit cards are powerful tools for those looking to build or rebuild credit. These cards require a cash deposit that becomes your credit limit, reducing risk for the issuer while providing you a path to credit improvement.

Secured credit card strategies:

- Choose a card that reports to all three credit bureaus

- Start with a small initial deposit

- Make consistent, on-time payments

- Gradually request credit limit increases

- Plan to transition to an unsecured card

Strategy 5: Negotiate and Settle Old Debts

Dealing with old debts strategically can significantly improve your credit score. This isn’t about avoiding responsibilities, but about smart negotiation and settlement.

Debt negotiation approaches:

- Communicate professionally with creditors

- Request debt validation

- Negotiate settlement amounts

- Get settlement agreements in writing

- Understand the impact on your credit report

Strategy 6: Timing Your Credit Applications

The timing and frequency of credit applications can dramatically affect your credit score. Strategic approach is key to minimizing negative impacts.

Credit application strategies:

- Understand hard vs. soft credit inquiries

- Space out credit applications

- Limit applications to necessary instances

- Cluster similar loan applications within a short timeframe

- Research pre-qualification options

Strategy 7: Leverage Alternative Credit Data

Modern credit scoring is evolving, and alternative data sources can help improve your credit score.

Alternative credit data strategies:

- Use rent reporting services

- Report utility and phone bill payments

- Explore financial technology platforms

- Understand emerging credit scoring models

Strategy 8: The Debt Snowball vs. Debt Avalanche Method

Choosing the right debt repayment strategy can accelerate your credit score improvement.

Debt repayment comparison:

- Snowball Method: Pay smallest debts first for psychological wins

- Avalanche Method: Pay highest interest debts first for financial efficiency

- Combine strategies based on personal motivation

- Maintain consistent payments

- Celebrate small victories

Strategies 9-15: Rapid Fire Credit Score Boosters

Additional quick strategies to improve your credit score:

- Set up automatic bill payments

- Explore credit builder loans

- Keep old credit accounts open

- Limit new credit applications

- Use credit monitoring services

- Create a diverse credit mix

- Build an emergency fund

Skale Money Key Takeaways

- Improving your credit score is a strategic, patient process

- Small, consistent actions create significant improvements

- Monitor your credit regularly

- Be proactive in managing your financial health

- Understand that credit repair takes time

Conclusion

Your credit score is not a fixed destiny, but a dynamic financial tool you can shape and improve. By implementing these 15 strategies, you’re not just improving a number—you’re opening doors to financial opportunities, reducing stress, and building a stronger economic future.

Take the first step today. Choose one strategy, implement it, and watch your credit score transform.

Frequently Asked Questions (FAQ)

How long does it take to improve a credit score?

Improvements can be seen in 1-3 months, with significant changes taking 6-12 months of consistent effort.

Can I improve my credit score without a credit card?

Yes, through strategies like reporting rent and utility payments, using credit builder loans, and maintaining a strong payment history.

Are credit repair companies worth it?

Most strategies can be done independently. Professional help might be beneficial for complex situations, but be cautious of scams.

How often should I check my credit report?

Check at least annually, or every four months by rotating between the three major credit bureaus.

What’s the fastest way to raise my credit score?

Reduce credit utilization, dispute errors, and make consistent, on-time payments.

Do student loans affect credit scores?

Yes, they impact credit mix, length of credit history, and payment history.

Can closing a credit card hurt my credit score?

It can, by reducing available credit and potentially shortening credit history.

Disclaimer: Individual financial situations vary. Always consult with a financial advisor for personalized guidance on how to improve credit score.

![]()